What To Watch For In Salesforce’s Q1 Earnings

Recently, Salesforce (NYSE:CRM) disclosed buying 4.9 million shares of Dropbox, which since its IPO price of $21, has risen by over 40%. Investors reacted positively, with the company’s stock price going up marginally. Moreover, as the company is expected to post another strong quarter on Thursday, May 17, it could further boost the stock price. The company expects to generate revenues of $2.93 billion in Q1, representing over 23% year-over-year growth. We have created an interactive dashboard which shows our forecasts for the company’s revenues. You can modify the different revenue drivers to see how changes impact the company’s expected revenues. With customer preferences shifting towards cloud-based products, the company’s enterprise cloud computing solutions – which include apps and platform services, as well as professional services to facilitate the adoption of its solutions – will play a key role in driving its growth.

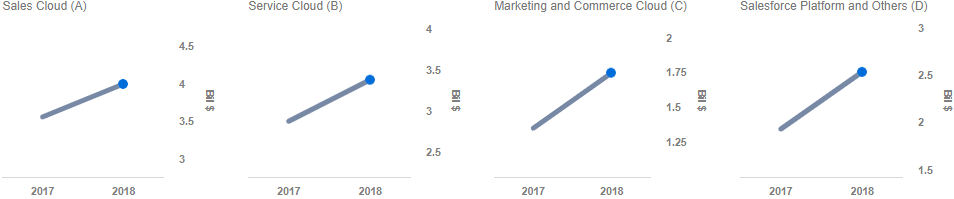

Salesforce is relying on its AI CRM platform Einstein to further the adoption of the company’s cloud solutions. Sales Cloud – the company’s flagship product – continues to be the largest contributor to the Subscription and Support segment. In the previous quarter, Service Cloud grew by 28% and Marketing and Commerce Cloud saw a revenue increase of 33%. We expect continued growth across the CRM and software businesses.

- Down 7.3% In A Day, Where Is Salesforce Stock Headed?

- Up 69% In The Last Twelve Months, What To Expect From Salesforce Stock?

- Up 74% Since The Beginning of 2023, Will Salesforce Stock Continue Its Strong Rally?

- Salesforce Stock Is Undervalued

- Salesforce Stock To Edge Past The Consensus In Q1

- Salesforce Stock Is Trading Below Its Fair Value

Sales and R&D expenses, which have continued to grow in absolute terms, have seen a drop as a percentage of revenues over the past few quarters, and we expect that trend to continue. Moreover, with a low attrition rate and an expanding customer base and product portfolio, we believe that the growth in sales and R&D expenditures is justified.

Margins are expected to improve due to the likelihood of increased adoption across product lines. We expect an increased adoption rate internationally, as the demand for cloud solutions and integrated end-to-end CRM solutions with AI support grows globally. However, as the company is focused on customer-centric growth and will likely remain acquisitive in the near term, it may continue to see some pressure on its bottom line.

We believe that the Salesforce stock is worth nearly $118, which is below the market price.

See our complete analysis for Salesforce

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.