Why Has Cree Doubled Over The Last 2 Years?

Cree’s (NASDAQ: CREE) stock has risen almost 2x over the past 2 years from $24 in September 2017 to $48 in September 2019. This has been primarily driven by a sharp rise in the Price-to-Sales (P/S) multiple, which has more than doubled since September 2017. Revenue has more or less remained flat, but the growth in the P/S multiple has largely offset the 5% rise in the number of outstanding shares.

View our interactive dashboard analysis Cree: Why is the stock up 2x in 2 years?

We break down the change in Cree’s stock into 3 factors: Stock Price = (Revenue / No. of Shares) x P/S Multiple

1. Cree’s Revenue has largely remained flat

- Revenue from Cree’s Wolfspeed segment, that sells Power and RF products, has seen strong growth over the past 2 years, on the back of growing demand.

- However, this growth has been offset by the drop in revenue for the lighting products segment (which has now been divested), on the back of falling demand.

2. A look at why Cree’s P/S multiple has more than doubled over this period, even though total revenue has stayed mostly flat

- Cree’s P/S multiple has grown 96% in the past 2 years, from 1.63 in 2017 to 3.32 in 2019.

- This growth has been due to strong revenue expectations going forward, largely driven by rapid growth in revenue from the Wolfspeed segment.

- The divestment of the under-performing lighting segment has also played a role in this increase.

a. The divestment of the fading-out lighting segment

- This rise has been largely due to Cree announcing the divestment of its lighting products segment, which was a low-margin operation that faced intense competition.

- Toward the end of fiscal ’19, Cree sold its lighting business to IDEAL industries.

b. This will help Cree focus more on the Wolfspeed segment which has been seeing rapid growth

- Cree’s Wolfspeed segment has seen robust growth of late, with revenue growing 63.8% YoY for 2019.

- Wolfspeed’s share in Cree’s revenue has also gone from 15% in 2017 to 35.9% in 2019, and is bound to increase after the recent divestment of the lighting segment.

c. Wolfspeed’s margins have consistently been higher than Cree’s overall gross margins

- Wolfspeed’s gross margins have grown from 46.8% in 2017 to 48.1% in 2019.

- Meanwhile, Cree’s overall gross margins have hovered around the 30% mark.

- The increased focus on Wolfspeed, and its increased share in Cree’s revenue, is a positive move for Cree’s profit margins going forward.

d. Comparing Cree’s P/S multiple to that of its competitors

- Just like Cree, Analog Devices and Texas Instruments have both seen a steady growth in their P/S ratio over the past 2 years.

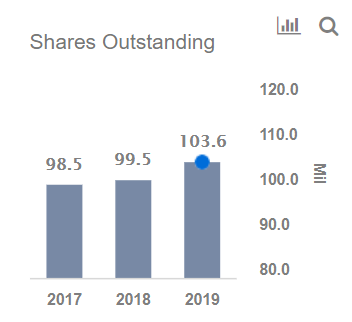

3. The Number of Outstanding shares has seen a 5% rise over the past 2 years

- The outstanding share count has seen a rise, due to issuance of new shares and the exercise of stock options.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.