The Factors Behind Cree’s Recent Stock Rally

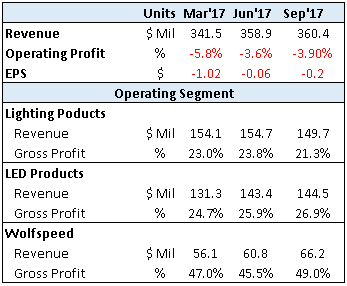

LED manufacturer Cree‘s (NYSE:CREE) stock price is up by over 40% in the past three months, as the company’s performance has improved sequentially in terms of revenues and margins. This comes as a source of respite for management, which is expecting a turnaround in its business in the upcoming quarters. However, the company’s top line and profitability has declined in comparison to the prior year comparable period, owing to fierce competition in the LED industry, which has suppressed LED prices and Cree’s market share. Below we take a look at what has driven the rally in the company’s stock, and what to expect looking ahead.

Our price estimate for Cree’s stock stands at $22, which is well below the market price following the recent rally.

What Has Gone Well For The Company?

- Building capacity in the Wolfspeed business: Revenue and gross margins from this segment grew at a strong pace sequentially each quarter. This is attributable to higher factory utilization and improved production. The company is seeing significant demand in silicon carbide and is currently working on improving capacity.

- Expanding LED product portfolio: Supported by a favorable product mix, the company’s revenue and gross margin improved every quarter. Cree is expanding its LED product offering with new high-power and mid-power products that leverage its market leadership. The company has entered into a joint venture with San’an, which can help Cree increase its presence in the mid-power LED component market.

- Growing Lighting revenue and increasing margins: The company is looking to boost revenues and margins by investing in channel relationships, improving execution, and continuing to deliver innovative lighting solutions.

Given the current state of the Lighting business, Cree has reevaluated the business to identify spending that is not aligned with its current growth strategy. As a result, it plans to take actions to remove certain costs that are targeted to yield an $8 million annual benefit. Cree believes that, even though the previous quarters were soft, the non-residential construction market will pick up in subsequent months. With an expanded product range, the company hopes to get into new applications, which can drive growth going forward. Despite that, it will take several quarters to rebuild significant growth momentum in the Lighting business.

Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap |More Trefis Research