Will ConocoPhillips Manage To Enhance Its Shareholders Value In The Current Commodity Slump?

Since the dawn of the commodity slowdown in mid-2014, ConocoPhillips (NYSE:COP) has seen a drastic dip in its revenues as well as profitability. This has not only resulted in lower cash flows from operations but has also raised concerns over the sustainability of its capital expenditure and dividend payments. However, the company returned to profitability in the last quarter, despite the persistent volatility in commodity prices, backed by the success of its asset divestment program, and operational efficiencies derived from its existing wells. This indicates that the company’s strategies to withstand the oil slump are finally bearing fruit. However, given a highly levered capital structure and prolonged weakness in commodity prices, the investors continue to be wary about the company’s ability to sustain its shareholder returns in the coming quarters. In this article, we explore the company’s targets with respect to enhancing the return of its shareholders and its ability to achieve them.

See Our Complete Analysis For ConocoPhillips Here

Source: Google Finance; US Energy Information Administration (EIA)

- Up 15% In Last Six Months, Will ConocoPhillips Stock Continue To Grow Post Q3?

- ConocoPhillips Q2 Earnings: What Are We Watching?

- What’s Next For ConocoPhillips Stock?

- ConocoPhillips Stock To Likely Trade Higher Post Q4

- This Stock Appears To Be A Better Bet Than EOG Resources

- Earnings Beat In The Cards For ConocoPhillips Stock?

Asset Sales To Provide Cash Cushion

In order to remain afloat in the turbulent times, ConocoPhillips has been actively managing its operations and cash flows over the last couple of years. The US-based company has tried to sustain a flat production growth with restricted capital investment over the last two years. For this, the company has divested a number of its non-core and low-margin assets over the last few quarters. Year-to-date, the company has completed two major asset sales – Canadian oil sands and San Juan Basin assets – that have enabled it to generate cash proceeds of more than $13 billion. This has not only allowed the company to raise significant cash to enhance its highly levered balance sheet, but has also bolstered its bottom line due to the elimination of low-margin assets.

In addition to this, ConocoPhillips recently revised its capital spending budget from $5 billion to $4.8 billion for the current year, in the wake of the uncertainty regarding the pace of recovery of commodity prices in the near term. While the company has the flexibility to utilize a portion of its sales proceeds to fund its capital expenditure, the majority of its capital spend is likely to be funded from its operational cash during the year. This will provide a cushion for the company to use the divestment proceeds to improve its shareholders’ return.

ConocoPhillips’ Priorities In The Current Downcycle

Higher Share Repurchase To Enhance EPS & Shareholder Value

ConocoPhillips continues to remain focused at creating higher value for its shareholders through higher share repurchase and dividends, unlike its peers who are expanding their production to capitalize on the anticipated recovery in commodity prices. It aims to pay 20% to 30% of its cash flows from operations to shareholders through dividend and share buybacks over the next few years. In this regard, the company had planned to repurchase $1 billion worth of stock in 2017 and up to $3 billion by 2019. However, with the cash proceeds from the sale of its Canadian assets, the exploration and production (E&P) company has authorized an additional sum of $3 billion for its share repurchase program to be completed over the next three years. With this, ConocoPhillips aims to buy back $3 billion in stock in 2017, and a total of $6 billion by 2019. The decision will help the company to optimize its capital structure, while augmenting its earnings per share in a weak and uncertain oil price environment.

Besides this, one of the company’s priorities is to maintain a sustainable dividend through the commodity cycles, and focus on growing it at a modest rate annually. Consequently, ConocoPhillips increased its quarterly dividend by 6% to 26.50 cents per share earlier this year. This indicates the company’s improving cash flow position and its willingness to share its progress with its shareholders.

Source: Barclays CEO Energy Conference, September 2017

Lower Debt To Boost Returns Further

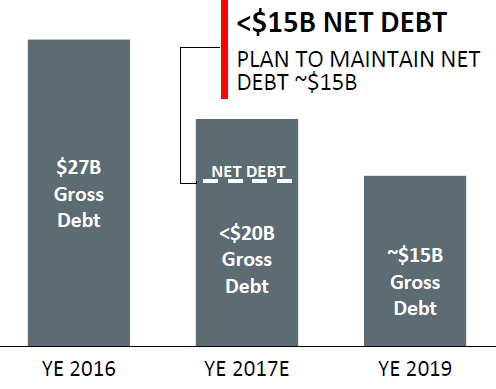

Apart from repurchasing a sizeable amount of its own stock, ConocoPhillips plans to pare down a significant portion of its long term debt over the next couple of years, with an aim to improve its credit rating in the market. As per the latest company presentation, the management expects to repay $7 billion of debt in 2017, of which more than $4 billion has been already repaid in the first half of the year. This implies that the company is on track to achieve its target of attaining a net debt position of $15 billion at the end of the year. Further, the company plans to bring down its long term obligations to $15 billion (gross) by 2019.

With reduced debt on its books, ConocoPhillips should be able to achieve its target of an “A” credit rating by the end of this decade. In fact, with the news of significant debt reduction and increased share buyback, both S&P and Moody’s have already improved their rating outlook for the company. This is a positive sign for the company as its strategy to bring down its leverage and optimize its capital structure is reaping expected results.

ConocoPhillips’ Long Term Debt Target

Thus, in conclusion, we believe that while ConocoPhillips has struggled to maintain its profitability in the oil slump, it has made a strong comeback with its strategies in the last few quarters. The continued achievement of its targets, coupled with a gradual recovery in the commodity markets, could enable the company to meet its objective to enhancing its shareholders’ return.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap