How Are Oil Prices Impacting CME’s Energy Derivatives Trade Volumes?

CME Group (NASDAQ:CME) has seen a significant increase in its energy contract trading volume over the last two years, largely driven by the increased uncertainty in oil prices. Continued volatility in the oil market is likely to boost the exchange’s trading volumes further in the future. Below we take a look at how oil prices impact the exchange’s energy derivatives volumes.

How Important Is Energy Derivative Trading For CME?

CME derives almost 85% of its revenue from its transaction-based operations, of which energy derivatives contribute a significant proportion. Energy derivatives account for almost 20% of CME’s overall revenue, and about 25% of our price estimate for the company’s stock.

Is There A Correlation Between Energy Trading Volumes And Oil Prices?

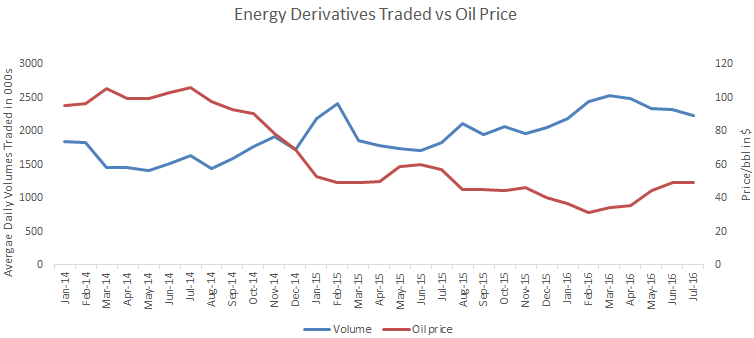

Over the last two years, CME has witnessed a surge in its energy contract volumes, largely due to an increase in crude oil contract volumes. This steep rise was primarily driven by volatility in the crude oil market, caused by plummeting oil prices that began in the third quarter of 2014. Higher oil supply and OPEC’s unwillingness to cut down on oil production, coupled with weak global demand for oil, led to a demand-supply mismatch that resulted in instability in prices. From over $100 per barrel in June 2014, oil prices declined to a low of under $30 per barrel in February 2016.

However, unlike oil and gas companies, CME actually benefited from this global trend. The declining oil prices encouraged trading activity in the energy derivative segment, which in turn boosted the exchange’s transaction-based revenue from the segment. CME’s energy derivative revenues increased by more than 35% over the last two years, while its overall revenue grew by only 20% during the same period.

Examining the relationship between oil prices and CME’s energy derivative volumes, one can find a fairly strong negative correlation between the two. As can be seen from the table below, the two factors have a negative correlation coefficient of approximately 88%, implying that a 1% decrease in oil price could cause a nearly 0.9% increase in CME’s energy derivative volumes. While this trend could vary due to macro factors, it has been fairly consistent throughout the ongoing commodity downturn.

What To Expect

The downturn in oil prices has been prolonged, which has led to increased uncertainty in the market. Consequently, we expect that continued uncertainty or volatility will result in sustained high volumes for CME. Since the outlook for commodity prices remains uncertain, it is likely to drive the exchange’s revenues in the coming quarters. In the table below, you can modify the forecast for CME’s average daily energy contract volumes to see the impact on the company’s valuation.

See the full Trefis analysis for CME Group.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research