A Closer Look At Colgate-Palmolive’s Performance in 2017

Colgate Palmolive (NYSE:CL) announced mixed 2017 results so far, as its earnings per share came in ahead of market expectations but revenue missed in the first quarter, while its earnings per share estimates came in line with analysts’ expectations in the second and third quarter, with the revenue estimates missing in the second quarter. However, the company’s stock is nearly 15% higher since the beginning of the year.

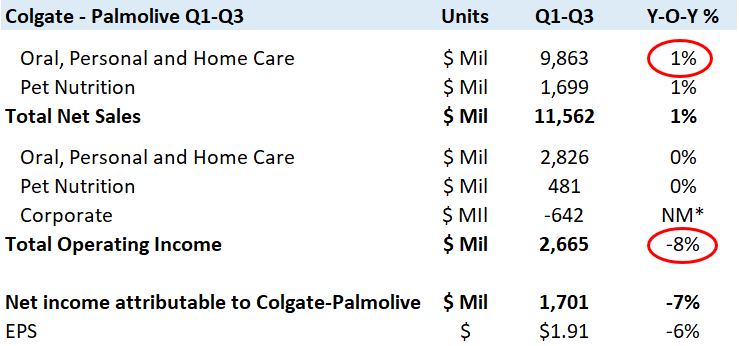

In the first nine months of 2017, Colgate’s net sales were up 1% year-over-year (y-o-y), as volume declines of 0.5% were more than offset by net selling price increases of 1.0% and positive foreign exchange of 0.5%. The company benefited from healthy volume increases across Latin America and Europe in this period. Colgate’s organic sales grew marginally at 0.5% y-o-y in the first three quarters, driven by an increase in organic sales in Oral Care, partially offset by a decrease in organic sales in Personal Care and Home Care. While declines in the liquid soap and underarm protection categories resulted in a decrease in Personal Care organic sales, a drop in the hand dish category led to a decrease in Home Care organic sales, which was partially offset by gains in liquid cleansers and fabric softener categories. In addition, Hill’s Pet Nutrition revenues increased 1% y-o-y, as growth in Prescription Diet category was partially offset by declines in Advanced Nutrition and Naturals categories.

On a GAAP basis, the company’s gross margin grew 1% y-o-y at 60.1%, driven by cost savings from its Funding the Growth initiative and restructuring program, partially offset by higher raw and packaging material costs. Its operating profit margin was down 210 bps y-o-y to 23% in this period, primarily due to growth in advertising investments and overhead expenses.

- Should You Pick Colgate-Palmolive Stock Over Monster Beverage After The Latter’s 2x Gains This Year?

- Should You Pick Colgate-Palmolive Stock After A Q3 Beat And 4% Gains This Month?

- Is Colgate-Palmolive Stock A Better Pick Over Marriott?

- Which Is A Better Consumer Defensive Pick – Kimberly-Clark Or CL Stock?

- Should You Buy Colgate-Palmolive Stock At $80?

- Should You Buy This Households & Personal Products Company Over Colgate-Palmolive Stock?

Almost 75% of Colgate’s net sales are generated from markets outside the U.S., with approximately 50% of the company’s net sales coming from emerging markets (which consist of Latin America, Asia (excluding Japan), Africa/Eurasia and Central Europe). In the first nine months of 2017, the company’s net sales in Latin America grew 7.5% y-o-y, with organic sales up 6.5% y-o-y, driven by volume growth of 2.0% and net selling price increases of 4.5%. However, the company’s performance in geographies other than Latin America remained weak. To add to that, the company’s organic volume also declined in all the regions of its operation, except Latin America and Europe. These lower volumes represent a tough competitive environment which could offset the advantages of increased advertising to some extent until there is some improvement in the market growth rates, led by a rebound in the consumer demand.

Future Outlook

Going forward, Colgate-Palmolive continues to expect both its net sales and organic sales to increase at a low single-digit rate for the full year. The company also expects its full-year GAAP earnings per share to be down mid-single digits, and non-GAAP earnings per share to be down low-single-digits. In addition, the company expects its gross margin expansion to be in the range of 20 to 50 bps this year as compared to its previous outlook of the lower end of the 75 to 125 bps range. This reduction is due to a combination of higher raw material costs and less of a benefit from pricing in the first nine months of fiscal 2017.

Our $75 price estimate for Colgate-Palmolive is in line with the current market price.

See our complete analysis for Colgate-Palmolive