What To Expect From China Unicom’s Q4 Results

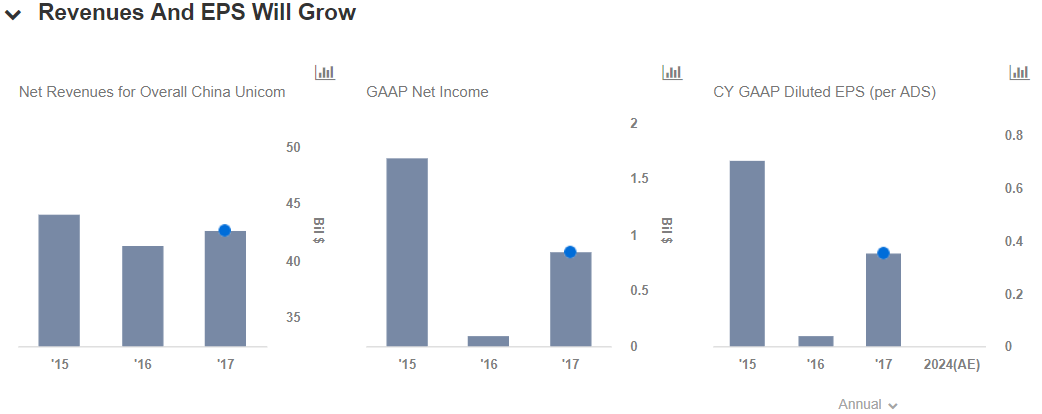

China Unicom (NYSE:CHU), the second largest Chinese wireless carrier, is expected to publish its Q4 and full year 2017 results on March 15. We expect the company’s earnings to see an improvement on a year-over-year basis, driven by its growing wireless subscriber base, higher ARPU and a growing mix of 4G wireless subscribers. Moreover, the company’s move to reduce costs by lowering equipment subsidy costs and transforming its sales and marketing model could also help its results. Below, we provide a brief overview of what to expect when the carrier publishes earnings.

We expect the carrier’s subscriber growth to pick up, driven by better 4G coverage and a transformation of its sales and marketing model. A higher mix of 4G users should aid its ARPU and margins.

- Is The Market Undervaluing Chinese Telcos: A Comparison With Verizon & AT&T?

- Will China Unicom Be Able To Shake Off Revenue Headwinds In 2020?

- China Unicom’s Revenues Should Trend Steadily Higher, Driven By Wireless Business

- A Look At China Unicom’s Subscriber Performance Over The First Half Of 2019

- China Unicom’s Earnings Grow On Lower Costs, Rising Wireless Subscriber Base

- What To Watch As China Unicom Reports FY’18 Results

On the other hand, China Unicom’s Landline business will likely continue to see steady declines, continuing the trend seen over recent years.

The Broadband business should see subscriber growth as the market expands, although its ARPU could remain under pressure amid significant competition from rivals such as China Mobile.

Lastly, we expect China Unicom’s revenues to see a modest year-over-year improvement driven by a higher wireless subscriber base and broadband growth. The carrier’s EPS should improve driven by higher ARPU, lower equipment subsidy costs and a transformation of the sales and marketing model.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own