How Are Regulatory Changes Likely To Affect China Mobile’s Revenues In 2020?

Following the Chinese Government’s directive to the country’s telecom companies to upgrade speed and reduce tariff in 2017, the shares of China Mobile (NYSE: CHL) have lost 30% of their value. Over recent months, even as the company geared-up for 5G launch, the elimination of domestic roaming call and data charges coupled with another round of reduction in mobile data charges to promote the Chinese Government’s Digital China initiative has weighed on revenues. Despite the significant impact of regulatory directives on the company’s topline, 4G DOU (the average handset data traffic per user per month) surged 133% (y-o-y) to 7.1 GB during the first half of 2019. While lower tariffs have played an important role in this surge in data usage, and will play a key role in unlocking value for China Mobile in the long run, we expect China Mobile’s Revenues to trend lower in 2020. We detail our forecast for the company’s revenues an interactive dashboard, parts of which are highlighted below.

A Quick Look At China Mobile’s Revenues

China Mobile reported $111 billion in Total Revenues for full-year 2018. This included three revenue segments:

- Data Services: $82 billion in FY2018 (74% of Total Revenues). It includes income from wireless data, wireline data (broadband), SMS/MMS services, and application services such as IoT.

- Voice Services: $16 billion in FY2018 (15% of Total Revenues). It represents income from voice calls over the company’s network

- Product Sales: $13 billion in FY2018 (11% of Total Revenues). The company promotes handset sales bundled with various service discounts as a means to expand its customer base.

- Is The Market Undervaluing Chinese Telcos: A Comparison With Verizon & AT&T?

- What Is Driving Our $49 Price Estimate For China Mobile?

- How Does China Mobile’s Wireless Business Compare With Its Peers?

- How Does China Mobile’s Wireline Broadband Business Compare With Its Peers?

- Key Trends To Watch As China Mobile Reports Its Q4 And FY’18 Results

- Why China Telecom Continued To Outperform In January

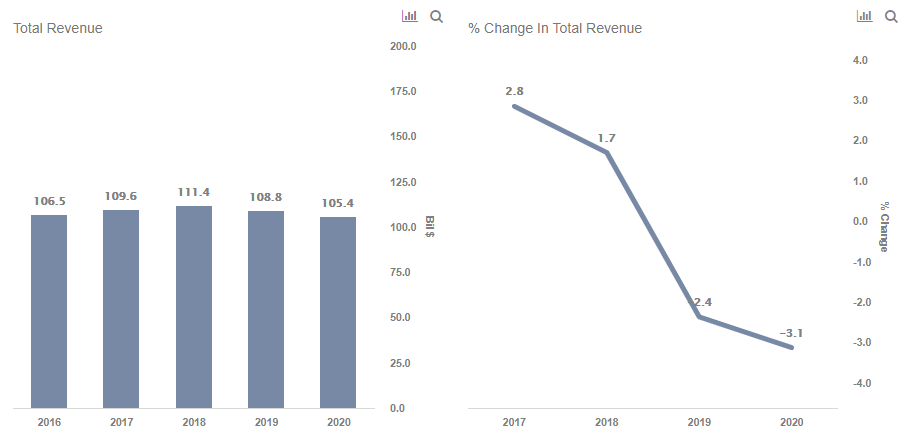

Total Revenues to trend lower in 2020

- Since 2016, the total revenues have been growing at a low single-digit rate primarily from increasing demand for wireless/mobile data.

- However, revenue growth turned negative due to the ongoing reduction in mobile and broadband data tariffs.

- The Data Services segment has been cannibalizing the Voice Services segment as users shifted from traditional network calls to internet-based VoIP calls.

- Consistent with the directive of a 20% reduction in data tariffs by 2020, we expect China Mobile to continue facing revenue pressure in the near term, despite higher data consumption and widespread availability of 5G services.

- We expect the company to lose $6 billion in total revenues over 2019-20 from the recent regulatory directives.

Lower data tariffs leading to a surge in consumption

- In 2018, China Mobile reported average monthly handset data traffic per 4G user (DOU) of 4.3 GB, growing by more than 100% over the prior year.

- The growing data consumption trend has continued in 2019, with the company reporting a DOU of 7.1 GB in its interim report.

- Moreover, IoT smart connections have been growing at an exponential rate with the company adding 142 million new connections during the first half of 2019.

- This has led to a surge in Application and Information Service revenues, which have been growing at a double-digit rate despite relatively flat overall Data Service revenues.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

All Trefis Data

Like our charts? Explore example interactive dashboards and create your own