Chesapeake’s 2Q’17 Earnings To Be Driven By Higher Price Realizations; Capex Revision Could Be In The Cards

Chesapeake Energy (NYSE:CHK), the second largest natural gas producer in the US, is likely to post a strong improvement in its June quarter financial results before the market opens on 3rd August 2017((Chesapeake Energy To Announce June Quarter 2017 Results, 13th July 2017, www.chk.com)). The E&P company’s revenue are expected to be higher compared to the same quarter of last year due to higher prices realizations during the second quarter. Further, the US-based company’s efforts to curb its operating costs are estimated to bolster its bottom line. That said, the company’s management had hinted at a slower improvement in its financial health in May 2017, and shifted the target of attaining cash flow neutrality by 2018 out to 2020. Thus, we will keep a close watch on the company’s 2Q’17 financial numbers to evaluate the progress of its strategy and its possible impact on its valuation.

See Our Complete Analysis For Chesapeake Energy Here

- Will Chesapeake See Improved Results In 2019?

- Higher Oil Output And Better Pricing To Drive Chesapeake’s 3Q’18 Results

- Factors That Will Drive Chesapeake Energy’s Value In The Next Two Years

- Chesapeake Q2 Earnings Preview: Commodity Price Strength and Operational Efficiency To Drive Growth

- What Factor Is Driving Chesapeake’s Stock Rally?

- Key Takeaways From Chesapeake’s Q1

Key Trends Witnessed In 2Q1’7

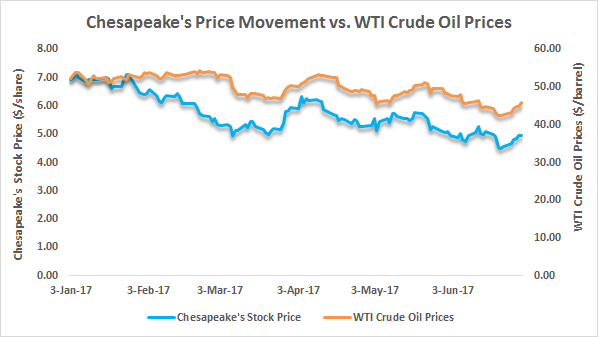

- The rebound in crude oil prices due to the OPEC production cuts came to a halt as the US oil production and inventory levels rose sharply in the second quarter. As a result, the WTI crude oil prices dropped from an average of $52 per barrel in the first quarter of 2017 to $48 per barrel in the latest quarter. Consequently, we expect Chesapeake’s price realization for the quarter to be lower than that of the previous quarter, impacting its June quarter revenues on a sequential basis. However, as mentioned earlier, the company’s revenue is expected to grow sharply as the commodity prices in the second quarter of 2017 were notably higher compared to the same quarter of last year.

Source: Google Finance; US Energy Information Administration (EIA)

- In anticipation of the recovery of the commodity markets, Chesapeake had announced an aggressive production target for the next three to four years. Accordingly, the company had raised its capital spending guidance from $1.9-$2.5 billion to $2.1-$2.5 billion. However, in the view of the uncertainty in the commodity markets, some of the E&P companies, such as Anadarko Petroleum and ConocoPhillips, have recently reduced their capital investment plans for 2017 and beyond. Consequently, we expect Chesapeake to follow suit and revise its capital expenditure for 2017. This will allow the company to preserve its dwindling cash flows and to be better prepared for the ongoing downturn.

- In order to improve its highly levered capital structure, Chesapeake announced the private placement of $750 million of 8% senior notes due in 2027 in May 2017, which it plans to utilize to pare down its outstanding debt due in the 2020-2022 timeframe. Although the move appears to be in line with its previous strategy, it will only defer the maturity of its obligations, and not reduce the overall debt from the company’s balance sheet. This implies that the company interest expenses will not reduce as a result of this deal, leading to no impact on the company’s declining profitability. Thus, we figure that even though Chesapeake has managed to extend the maturity of its debt beyond this decade, it still has a huge task of retiring $2-$3 billion of its debt and achieving 2x Net Debt-to-EBITDA ratio by 2020.

Chesapeake’s Debt Schedule

- Apart from reducing its debt, Chesapeake also plans to issue equity to the tune of $2 billion to improve its liquidity. The expansion of its shareholder base will provide the company an easier and much more effective way of correcting its excessively levered capital structure. However, the company’s plans need to be supported by the steady recovery in commodity prices to take shape and reap the desired results for the company.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap