How Has China Telecom’s Wireless Business Fared Versus Rivals?

China Telecom (NYSE:CHA) has been outperforming its larger rivals China Mobile (CHL) and China Unicom (CHU) in recent quarters, driven by its higher 4G coverage and its launch of new plans targeted at heavy data users. In this analysis, we take a look at how the three Chinese wireless carriers have fared in terms of key subscriber metrics in recent months.

View our interactive dashboard analysis How Has China Telecom’s Wireless Business Fared Versus Rivals?

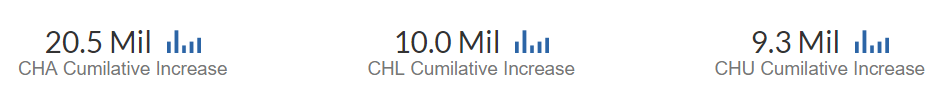

How Many Wireless Users Did Carriers Add Through June?

- China Telecom added a total of 20.5 million users, compared to 10 million for China Mobile and 9.3 million for China Unicom.

- Is The Market Undervaluing Chinese Telcos: A Comparison With Verizon & AT&T?

- How Are Regulatory Directives Hurting China Telecom’s Revenues?

- A Closer Look At China Telecom’s Key Revenue Streams

- What To Expect As China Telecom Reports Q1 Results

- Key Takeaways From China Telecom’s 2018 Results

- Key Trends To Watch As China Telecom Reports Its Q4 Results

China Telecom Looks Set To Replace China Unicom As Second Largest Carrier

- China Mobile remains the undisputed leader in terms of overall wireless subscribers, with over 930 million subscribers, while China Unicom is a distant second with 324 million subscribers.

- China Telecom looks set to overtake China Unicom in the coming months.

China Telecom Has Seen More Consistent Growth Compared To Rivals

- China Telecom has seen the most consistent subscriber additions, with an average of almost 3 million adds a month.

China Telecom Has The Highest Mix of High-Speed Data Users, But Unicom’s Mix Is Growing Faster

- About 82% of China Telecom’s user base is on high-speed data plans.

Conclusion

- While China Telecom looks set to replace China Unicom as the second-largest carrier, it is possible that its growth could slow going forward, due to increasing saturation in the Chinese wireless market.

- That said, its higher mix of high-speed data users could help drive its performance as the industry transitions to 5G.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.