What Are Celgene’s Key Sources of Revenue?

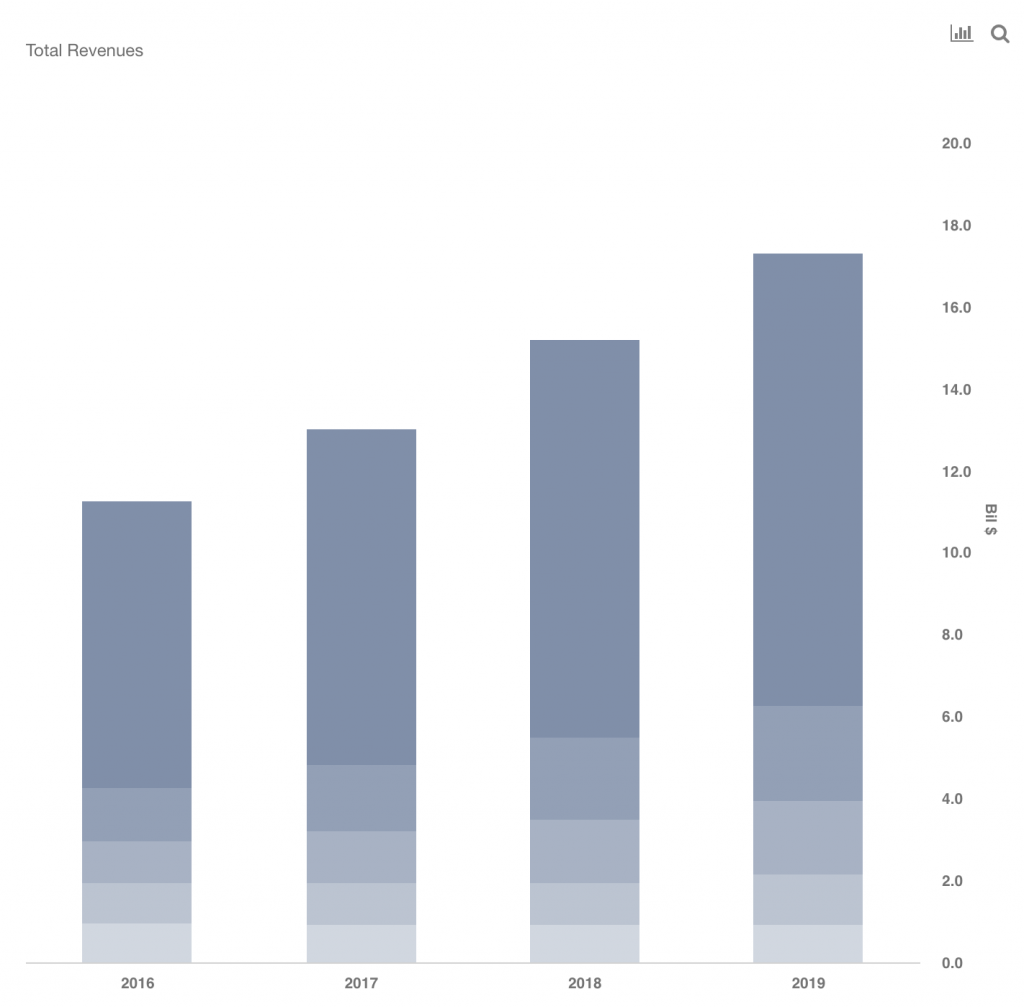

Celgene (NASDAQ:CELG) is a global biopharmaceuticals company, which has recently entered into a merger agreement with Bristol-Myers Squibb in a deal valued at $74 billion. Celgene generates its revenues primarily from sales of drugs used for the treatment of cancer and inflammatory diseases worldwide. Its top selling drug is Revlimid, which accounts for roughly 65% of the company’s overall revenues. We have created an interactive dashboard ~ What’s Celgene’s Revenue And Profit Breakdown? ~ which highlights the drug-wise breakup of revenues and profits for Celgene. You can also modify the revenue and profit drivers to see the impact on the company’s overall revenues and profits.

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

Celgene operates in two key therapeutic areas ~ Hematology /Oncology, and Inflammation & Immunology. The company’s blockbuster drug Revlimid is used for the treatment of multiple myeloma, mantle cell lymphoma (MCL), and myelodysplastic syndromes (MDS). The drug has seen stellar sales growth from $5.8 billion in 2015 to an estimated $9.7 billion in 2018. The drug’s peak sales are estimated to be as high as $15 billion by 2022, when it nears its patent expiration. The MDS market is expected to grow at a CAGR of around 10% till 2022 to an estimated $2.4 billion, and Revlimid’s share is estimated to be over 90%. However, in the MCL market it faces strong competition from Imbruvica and Rituxan. Pomalyst is another billion dollar drug for Celgene, with sales estimated to be over $2 billion in 2018. It is also used for the treatment of multiple myeloma. Otezla is used to treat psoriatic arthritis and plaque psoriasis, with estimated sales of over $1 billion in 2018. Overall, these three drugs account for roughly 90% of the company’s total revenues. Looking at operating margins, they grew from 28% in 2016 to 36% in 2017, and are estimated to be 34% in 2018, as per the company’s guidance, which translates into $5.2 billion profit.

Celgene’s late stage pipeline is attractive with ozanimod in immunology and inflammation, and luspatercept, liso-cel (JCAR017), bb2121, and fedratinib in hematology. These drugs have potential peak sales of over $10 billion. Bristol-Myers Squibb recently announced its plan to merge with Celgene. The combined entity will have revenues of over $37 billion, and earnings could be as high as $6 per share in the coming years, according to our estimates (See – Bristol-Myers Squibb & Celgene Combined Could Generate Earnings of Over $6 Per Share In The Coming Years).

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.