Why Caterpillar Is Worth $151

Caterpillar‘s (NASDAQ: CAT) stock fell nearly 10% after the company reported lower than expected Q4 earnings. Despite underperforming consensus estimates in Q4, Caterpillar achieved robust growth overall in fiscal 2018. The company’s revenue grew by more than 20%, while its stock price jumped nearly 70% in 2018. The company recorded its highest-ever adjusted earnings per share of $11.22 in 2018, primarily driven by higher sales volume across operating segments along with continued cost discipline. Caterpillar expects its 2019 profit to increase to the range of $11.75 to $12.75 per share, which was lower than the mean analyst expectations.

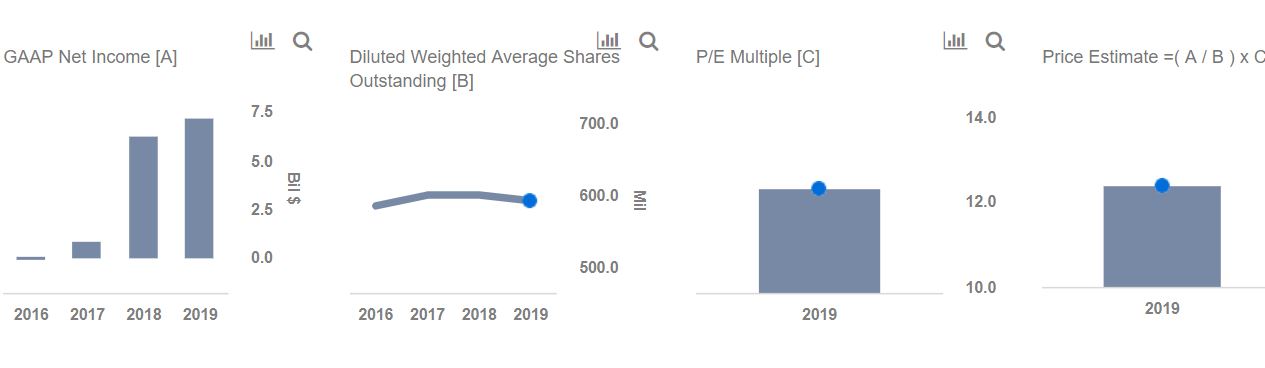

Our $151 price estimate for Caterpillar, which is around 10% ahead of the market price, is based on a forecast of around $55 billion in revenue in FY’19 and a forward PE multiple of 12x. We have summarized our full year expectations for CAT, based on the company’s guidance and our own estimates, on our interactive dashboard Will CAT Continue Its Growth Momentum in 2019? You can modify any of our key drivers to gauge the impact changes would have on its valuation, and see all Trefis Industrials data here. Below we outline some of the key factors that support our $151 price estimate:

What was the contribution of Construction Industries to Total Revenues?

- Construction industries drove overall growth for the company in FY 2018 – constituting approximately 42% of Caterpillar’s total revenues.

- Construction segment revenues surged by more than 20% to reach $23.1 billion in FY 2018.

- The strong performance was as a result of the robust demand for its products across North America and EMEA, coupled with significant investments in nonresidential construction, infrastructure, and oil & gas related projects, partially offset by subdued demand from China – largely driven by trade war tensions.

- This segment is expected to grow at a modest rate of 3% in FY 2019 with the segment revenues reaching approximately $24 billion.

- What Should You Do With Caterpillar Stock Ahead of Q1?

- Does Caterpillar Stock Have More Room To Grow After Its 25% Gain Last Year?

- Following A 39% Rise This Year Is Boeing Stock A Better Pick Over Caterpillar?

- Should You Pick Caterpillar Stock At $240 After An Upbeat Q3?

- Is Caterpillar Stock A Buy At $290 After A Solid Q2 Beat?

- Earnings Beat In The Cards For Caterpillar Stock?

What was the contribution of Resource Industries to Total Revenues?

- Resource Industries has been the fastest growing segment in recent years, adding more than $4 billion of revenue over 2016-2018 (CAGR of 31.2%).

- The growth was driven by improved demand for both mining and heavy construction equipment across regions and solid replacement demand, which in turn was driven by improved commodity prices and solid infrastructure investment, resulting in healthy order activity.

- The segment’s strong run is expected to continue in FY 2019 driven by strong demand for heavy construction in quarry and aggregate equipment.

- We expect the segment’s revenue to grow by about 6% y-o-y to about $10.5 billion in 2019.

What is the earnings forecast for Caterpillar in FY 2019?

What is the earnings forecast for Caterpillar in FY 2019?

- CAT reported its highest-ever adjusted EPS of $11.22 in FY 2018, driven by strong growth in revenues across operating segments and improved operating margin (15.9% in FY 2018 vs 12.5% in 2017)

- Caterpillar forecasts its adjusted EPS to be in the range of $11.75 to $12.75.

- The company didn’t provide guidance for its operating margin, but we expect the margins to remain similar to FY 2018.

- Our current price estimate of $151 for CAT is based on a 12x forward price to earnings multiple.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own