Can Construction, Resource, Energy & Transportation Businesses Drive Growth For Caterpillar In Q4?

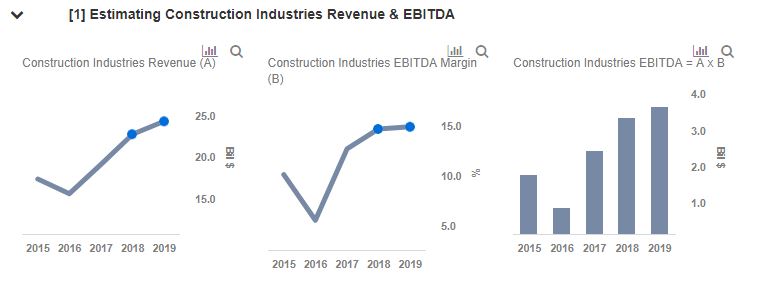

Caterpillar (NASDAQ: CAT) has had a robust year so far. The company’s revenue grew by nearly 24% in the first three quarters of 2018, and we expect this trend to continue when the company reports its fourth quarter earnings on January 28. We believe improved construction spending, coupled with the strengthening of U.S. GDP, healthy order backlog in most end markets, and sustained focus on cost cutting, should drive Q4 results. As a result, we expect a major chunk of its Q4 growth to be driven by solid performances from its Construction Industries and Energy & Transportation segments. In addition, solid outlook of Resource Industries segment should further boost Q4 earnings. Consequently, we expect Caterpillar’s 2018 revenue and EPS to grow by 19% and 69%, respectively, and Q4 results will likely be along the same lines.

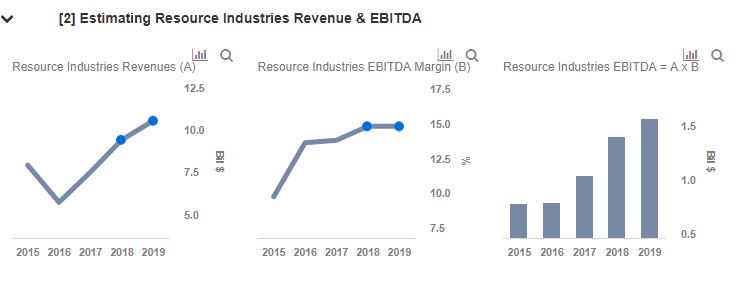

Our price estimate for Caterpillar’s stock stands at $160, which is around 15% above the market price. We have also created an interactive dashboard which outlines what to expect from CAT’s full-year results. You can modify the key value drivers to see how they impact the company’s revenues and bottom line. Below we discuss some of the key factors that are likely to impact the mining and construction equipment giant’s earnings.

- Does Caterpillar Stock Have More Room To Grow After Its 25% Gain Last Year?

- Following A 39% Rise This Year Is Boeing Stock A Better Pick Over Caterpillar?

- Should You Pick Caterpillar Stock At $240 After An Upbeat Q3?

- Is Caterpillar Stock A Buy At $290 After A Solid Q2 Beat?

- Earnings Beat In The Cards For Caterpillar Stock?

- Cross-Sector Comparison: Is Caterpillar Stock A Better Pick Over J&J?

The Resource Industry segment enjoyed a strong first nine months of 2018, as a result of higher replacement demand and demand for new mining equipment, which was driven by increased demand for fossil fuels in emerging economies, resulting in strong order activity. We expect this trend to spill over into Q4 and drive the segment’s revenue. Additionally, continued robust demand for its aftermarket parts should further drive its near term revenue. Further, an uptick in capital spending by multiple mining companies bodes well for the segment. In addition, recovery in commodity prices, coupled with full scale fleet replacement should drive increased end-user demand for new equipment. As a result, we expect this sector to grow by nearly 25% y-o-y to about $9.4 billion in 2018.