How Did Caterpillar Perform In Q1?

Caterpillar (NASDAQ: CAT) reported solid earnings this week, and raised its 2018 outlook notably. The company managed to beat both revenue and earnings estimates comfortably. The top and bottom lines for the quarter were boosted by improved sales volumes in the Construction, Resource, and Energy & Transportation segments, driven by increased end-user demand across most regions and markets. The company expects this trend to carry into 2018, driven by increased demand for its products and services. Below, we provide a brief overview of the company’s results and what lies ahead.

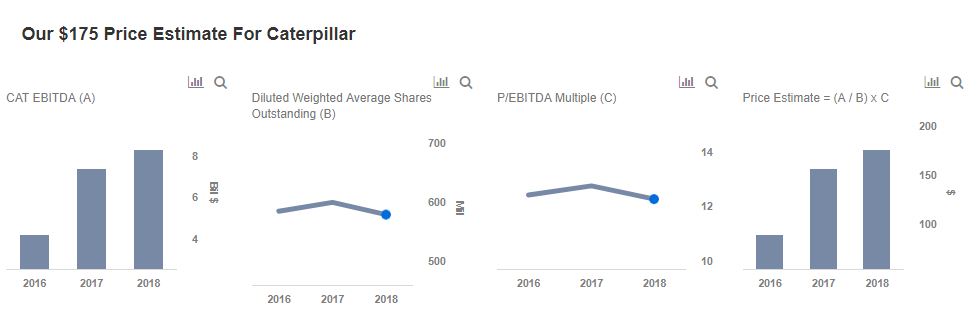

We have updated our model – maintaining a price estimate of $175 – and created an interactive dashboard analysis to estimate Caterpillar’s valuation based on its expected revenue for FY 2018. Click on the link to modify the figures to arrive at your own price estimate.

- Does Caterpillar Stock Have More Room To Grow After Its 25% Gain Last Year?

- Following A 39% Rise This Year Is Boeing Stock A Better Pick Over Caterpillar?

- Should You Pick Caterpillar Stock At $240 After An Upbeat Q3?

- Is Caterpillar Stock A Buy At $290 After A Solid Q2 Beat?

- Earnings Beat In The Cards For Caterpillar Stock?

- Cross-Sector Comparison: Is Caterpillar Stock A Better Pick Over J&J?

Caterpillar generates revenue from five segments – Construction Industry, Resource Industry, Energy & Transportation, Other Segments, and Financial Products. We expect growth in the former three to drive revenues for CAT going forward. The Construction Industry segment generates revenue from sales of construction equipment and services. Growing affluence and population, together with improved construction activities in developing markets – such as China and India – should drive spending. In addition, the increased construction activity in North America should further boost the revenue of this segment. Meanwhile, the Resource Industry segment generates revenue from sales of mining equipment and services. Recovery in commodity prices should drive increased end-user demand, and emerging economies will continue to drive the growth of the Mining Industry. Further, the increase in rail traffic in North America, coupled with improved global economic conditions – resulting in increased demand for industrial engines – should boost transportation & power generation sales.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams |

Product, R&D, and Marketing TeamsMore Trefis Research