Here’s Why We Believe BP’s Stock Is Worth $46 Per Share

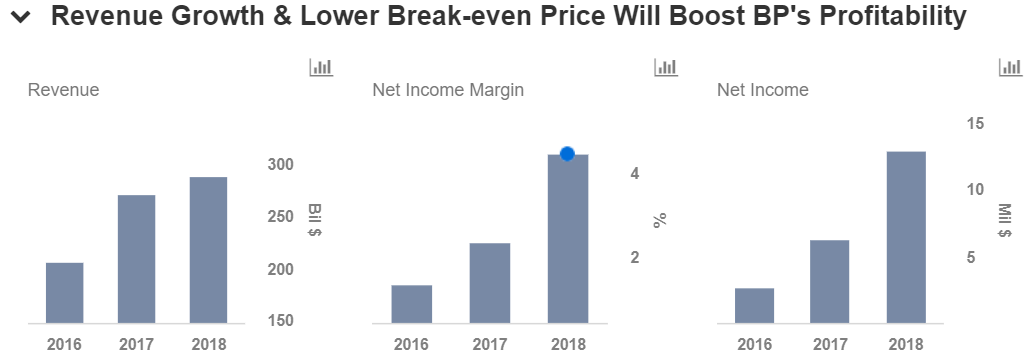

The year 2018 has been a good one for BP Plc. (NYSE:BP). On the one hand, the European company’s performance has improved drastically backed by the rebound in commodity prices in the last few quarters. On the other hand, the company has been delivering successfully on its expansion plans, by starting several major upstream projects under budget and on or ahead of schedule, setting a positive tone for 2018. Further, the company’s recent acquisition of BHP’s US onshore assets is expected to provide access to high quality assets in the Permian-Delaware, Eagle Ford, and Haynesville basins. Since these are low cost-high margin unconventional plays, this deal is likely to be accretive to the company’s earnings and cash flow and drive its value in the coming years. In this note, we discuss the factors that will drive BP’s performance and valuation in the near term.

We currently have a price estimate of $46 per share for BP, which is 7% higher than its market price. View our interactive dashboard – BP’s Price Estimate – which you can use to arrive at your own price estimate for the company by modifying the key drivers.

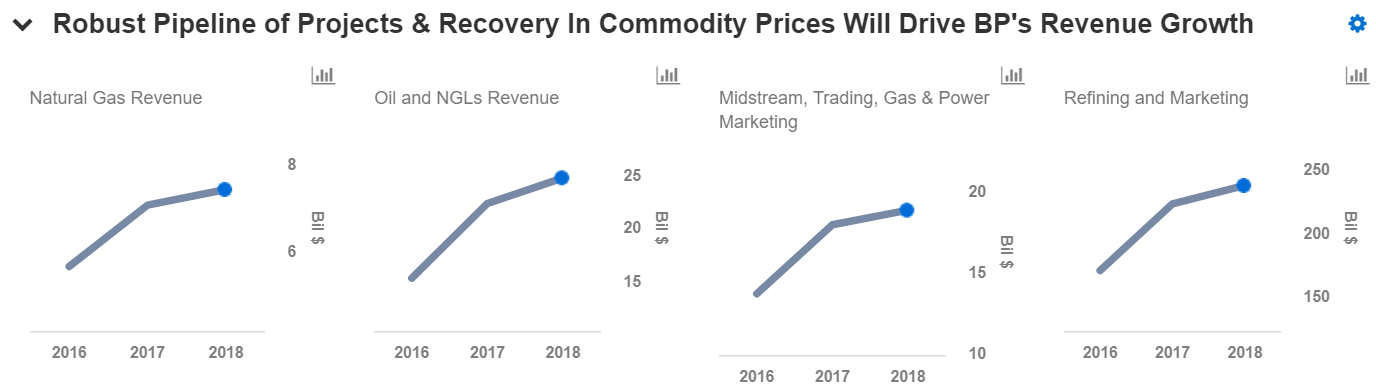

Robust Pipeline of Projects

After the heavy price paid for the Deepwater Horizon oil spill, BP has now decided to direct its execution capabilities and financial resources to enhance its future growth prospects. To fulfill this objective, the company commissioned seven major projects in 2017 and three new projects year-to-date in 2018. The company aims to commence production from three other projects this year and has made final investment decisions on five projects in Oman, India, the North Sea, and Angola. These projects will enable the company to add 900 thousand barrels per day (kboed) of incremental production by 2021 and capitalize the anticipated recovery in commodity prices in the coming years. This, coupled with a strong execution on part of the company, could drive its value in the long term and reinforce investor confidence.

BHP Acquisition

Over the last few years, BP has been transforming its Lower 48 operations by application of leading operational processes and advanced technologies. The company’s acquisition of BHP’s US onshore assets is its latest effort to build on its proven track record in the region. The deal will give BP access to superior quality liquids-rich assets in the Permian-Delaware basin, the Eagle Ford and Haynesville basins for a purchase consideration of $10.5 billion. The company aims to accommodate this deal within its medium-term financial framework by divesting $5-$6 billion of upstream assets to bring the net investment in the deal to around $5 billion.

The acquisition will to add incremental production of 190 kboed and over 4.6 billion barrels of oil equivalent of resources to BP’s portfolio. It is also likely to generate pre-tax synergies of over $350 million. The company expects the acquisition to be accretive to its earnings as well as cash flows per share post the integration and generate an additional $1 billion in upstream pre-tax free cash flow by 2021. Thus, we expect these assets to play a crucial role in the company’s value in the coming years.

Expansion of Downstream Operations

Apart from ramping up its upstream operations, BP has been focusing on a market-led-growth strategy for its downstream operations, particularly in its fuels marketing business. The company has been expanding its presence in major growth markets, such as China and Mexico, where it can offer differentiated high quality products and services to its customers. For instance, the company plans to have more than 300 BP-branded sites in Mexico and over 1,200 retail sites with convenience partnerships across regions. Further, the company continues to offer convenience retail in established markets, which will augment its downstream growth.

Additionally, BP has made a series of investments in the broader advanced mobility space to achieve its lower carbon footprint targets. For this, the company invested in Freewire (developer of fast-charging technology), StoreDot (leading developer of ultra-fast charging battery technology), and Chargemaster (the UK’s largest electric vehicle charging network operator) in the first half of the year. These investments will enable BP to position itself effectively in the fast-evolving electric vehicle market, while meeting its carbon emission targets. This is expected to aid BP’s valuation in the near term.

Do not agree with our forecast? Create your own price forecast for BP by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.