Higher Price Realizations & Production To Augment BP’s 2Q’18 Results

BP Plc. (NYSE:BP), the European integrated energy company, is set to post its financial numbers for the June quarter on 31st July 2018. The market expects the oil and gas major to experience a notable improvement in its annual revenue as well as earnings due to higher price realization and refining margins. Further, the company’s seven new projects that were commissioned last year are expected to contribute to its production growth and, in turn, its upstream revenue. Going forward, these projects, coupled with BP’s robust pipeline of projects, is expected to drive its value.

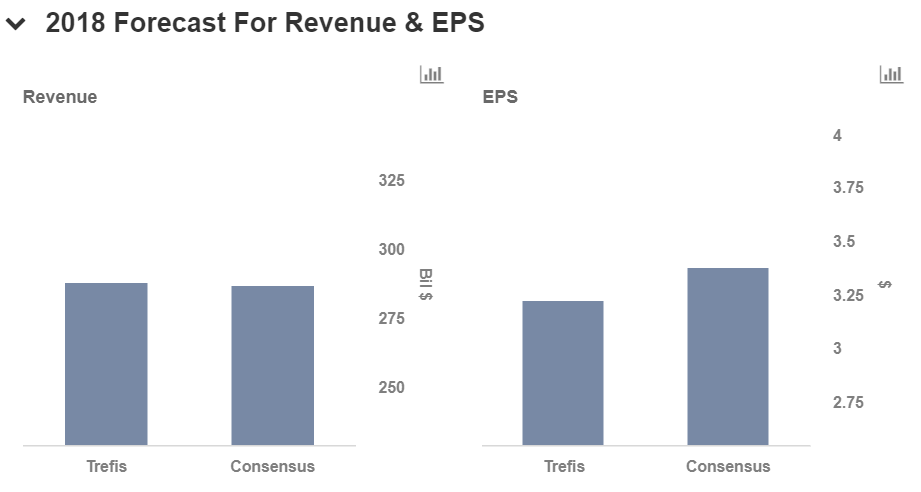

We have a price estimate of $50 per share for BP’s stock, which is higher than its current market price. View our interactive dashboard for BP and modify the key drivers to see the impact on the company’s valuation.

Key Trends To Watch For In 2Q’18 Results

- Crude oil prices witnessed a rebound in the first half of 2018 due to the extension of the Organization of Petroleum Exporting Countries’ (OPEC) production cuts until the end of 2018. The WTI crude oil prices averaged at around $68.06 per barrel for the June quarter, notably higher than the $48.10 per barrel of the same quarter of last year. Accordingly, we expect BP to see higher price realization for the quarter, which will, in turn, drive its upstream revenue.

- Apart from the improvement in upstream operations, BP’s downstream operations are also expected to augment its top-line growth, since the company plans to grow its retail network across existing markets as well as new markets such as India, Indonesia, Mexico, and China.

- In 2017, BP delivered seven major project start-ups in its upstream operations, mostly on schedule and under budget, emphasizing the company’s strong and disciplined execution. These projects, along with the ramp-up of the six start-ups in 2016, are expected to contribute to an increase in its upstream production.

Do not agree with our forecast? Create your own price forecast for BP by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.