Should Barclays Slash Its Trading Operations?

Barclays is reportedly under pressure from activist investor Edward Bramson to shut down a majority of its securities trading operations – a move aimed at shrinking the British banking giant’s exposure to the capital-intensive trading business while also improving the overall return on equity figure. The strategy makes sense, given the fact that Barclays securities trading operations in their current state lack the scale required to compete profitably with many U.S. investment banking giants. Notably, this has hurt returns for the bank’s investment banking division, with profits being bolstered primarily by its M&A advisory and debt and equity underwriting units.

We believe that a substantial restructuring of the bank could be good for investors both in the short run as well as in the long run, as detailed in our interactive model for Barclays. Shrinking most of its securities trading desk can help Barclays free up billions in locked up capital, which would improve the bank’s capital position while also allowing it to return more cash to shareholders. Further, given the relatively slim profit margins for the bank’s trading operations, a smaller, more focused trading unit could be accretive to Barclays’ investment banking margins in the long run. On the flip side, however, the reorganization plan could have a negative impact on Barclay’s short-term earnings and valuation. We estimate that these changes would reduce Barclays’s share price estimate from $12.50 to $11.60, which is around its current market price.

Does Barclays Really Need To Overhaul Its Investment Banking Division?

Barclays has had some difficulty cleaning up its balance sheet over recent years, with the bank disposing of most of its stake in the profitable Barclays Africa Group Limited (BAGL) to improve its capital structure as it reorganizes its business model to comply with the U.K.’s ring-fencing rule for banks. At the same time, the bank continues to incur multi-billion dollar charges to put its legacy legal issues behind it. The recent settlement with the DoJ resulted in a ~£2 billion one-time charge for Q1 2018, and will hurt profits for full-year 2018. Taken together, all these factors have weighed on the bank’s retained earnings – forcing it to cut down on dividends to maintain its core capital ratio.

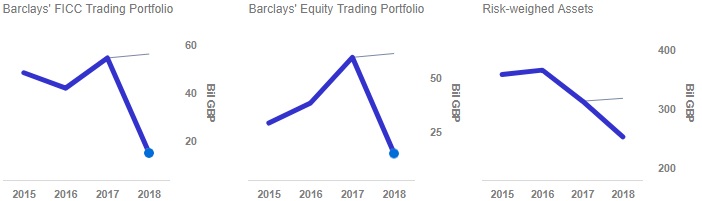

Given these circumstances, Barclays should take a closer look at its securities trading operations – especially because of the amount of capital they tie up. Notably, Barclays reported £114 billion in total securities trading assets at the end of 2017. If drastic cuts to the trading business are implemented, this figure could fall to as low as £30 billion by the end of the year. Assuming that the average risk weight for Barclay’s trading portfolio is 75% (i.e. a £100 reduction in trading assets results in a £75 reduction in total risk-weighed assets), this could potentially reduce the size of total risk-weighted asset base to ~£250 billion by the end of 2018, from £313 billion at the end of 2017. This would likely push Barclays’ core common equity tier 1 (CET1) capital ratio figure to almost 15% by the end of 2018 – comfortably higher than the bank’s target level of 13%.

In addition to reducing the asset base, the plan would increase Barclays’ cash on hand considerably. As this should boost the bank’s capital figure to a level much higher than needed to maintain its capital ratio target (and will have a negative impact on the return on equity figure), Barclays would likely return a bulk of this cash to shareholders in the form of a dividend hike as well as share repurchases.

Barclays returned just £509 million to shareholders in dividends in 2017, and we expect this figure would jump to £3 billion as a result of a potential decision to move forward with the trading cuts. This includes our estimate of £1 billion in dividends, and £2 billion in share repurchases.

Finally, the sharp reduction in trading assets would reduce Barclays’ total trading revenues, which would have a notable impact on the top line. However, the impact of this on Barclays’ EPS will be partially mitigated by an increase in overall operating income margin for the bank (as the trading revenues suffered from poor profit margins over recent years) and also by a reduction in the total number of common shares due to expected share repurchases.

We estimate that large-scale trading cuts would reduce Barclays’ EPS for full-year 2018 from our original estimate of £0.69 to £0.64. Using the new figure of £0.64 with our estimated P/E ratio of 13.5, this works out to a price estimate of ~$11.60 for Barclays’ shares (assuming a GBP-USD exchange rate of 1.35).

That said, if Barclays is able to implement the required changes successfully, it would be able to generate much higher returns for investors from its leaner business model in the long run. This should drive value for shareholders in the future.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own