Why BlackBerry’s Stock Has Been Underperforming

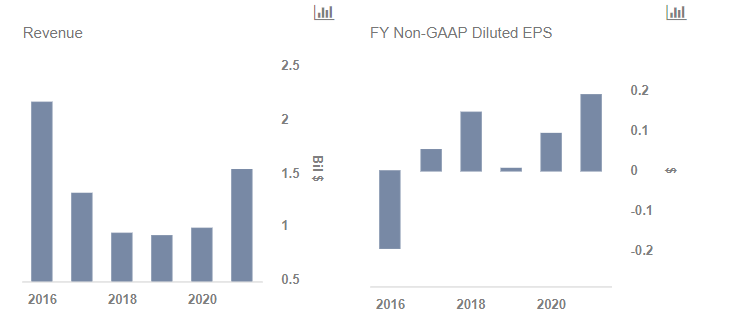

BlackBerry‘s (NYSE:BB) stock has underperformed the broader technology sector, and the overall market, of late. While the NASDAQ has rallied by about 16% year to date and by about 120% over the last five years, BlackBerry’s stock is down by about 11% year to date and has remained almost flat since 2013. While the company has been turning around its operations, exiting less profitable businesses such as handsets and eliminating costs via layoffs over the last few years, its revenues have seen a precipitous decline, falling from about $11 billion in FY’14 to just about $932 million in FY’18. As the company has largely run out inefficiencies and costs to eliminate, driving profitability will have to be aided by reversing its revenue declines going forward.

Our interactive dashboard analysis on What Will Drive BlackBerry’s Performance Over The Next 3 Years outlines our expectations for BlackBerry in the near term. You can modify key drivers to arrive at your own estimates for the company’s EPS and revenues.

Revenue Growth Challenges And Risks That Company Is Spreading Itself Too Thin

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

Blackberry’s near-term outlook for revenue growth also remains mixed. Revenues are projected to decline by almost 5% this year, as growth in Software and Services sales is unlikely to offset declines in the company’s high-margin Service Access Fee business (which saw revenues decline by 58% year-over-year in the most recent quarter). While the company is gaining traction in some core areas such as enterprise mobility management (EMM) and embedded systems software, the markets it is targeting are relatively small. For instance, the EMM market is projected to stand at just about $2 billion globally in 2018, per the Radicati group. Competition is also intense, and the industry is highly fragmented with multiple small players, limiting the long-term growth potential.

The QNX embedded software, which BlackBerry licenses to automotive vendors to power infotainment systems, may also be ripe for disruption. The software runs behind the scenes, with many car companies and other OEMs building out relatively underwhelming UIs and limited app-based functionality. Silicon Valley titans Apple (NASDAQ:AAPL) and Alphabet (NADDAQ:GOOG), Google’s parent company, have been increasingly interested in this space and there is a possibility that they could upend the market, given their large base of smartphone users and third-party developers (related: BlackBerry’s QNX Faces Significant Threats In The Auto Market). BlackBerry also has bets in several other fledgling or highly competitive areas such as autonomous driving systems, fleet tracking and the Internet of Things, but meaningful monetization may still be a long way off, and there is also a risk that BlackBerry may be spreading itself too thin.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.