Loan-To-Deposit Ratios For Largest U.S. Banks Show Signs Of Recovery In Q1

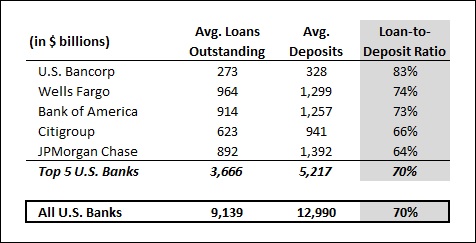

Loan-to-deposit ratios (LDRs) across the banking industry have declined steadily since 2010, but some of the largest U.S. banks witnessed a slight uptick in this key metric for Q1 2017 as loan growth outpaced deposit growth. The LDR ratios for the 5 largest banks ranges from around 65% for JPMorgan Chase and Citigroup to almost 85% for U.S. Bancorp. The significantly diversified business model for JPMorgan as well as Citigroup (which includes a large custody banking division for both of them) is primarily responsible for their relatively low LDR figures, while U.S. Bancorp’s traditional loans-and-deposits business model explains its higher LDR figure.

The table below captures the changes in LDRs for these banks over the last five quarters. Notably, Bank of America and U.S. Bancorp reported an increase in LDR figures, while the other banks witnessed a continued reduction in this ratio for yet another quarter.

- Trailing S&P500 by 26% Since The Start Of 2023, What To Expect From Bank of America Stock?

- Bank of America Stock Has An 83% Upside To Its Pre-Inflation Shock

- Bank of America Stock Is Trading Below Its Intrinsic Value

- Bank of America Stock Is Trading Below Its Intrinsic Value

- Is Bank Of America Stock Undervalued?

- Is Bank of America Stock Fairly Priced?

The loan-to-deposit ratio is the ratio of a bank’s total outstanding loans for a period to its total deposit balance over the same period. So an LDR figure of 100% indicates that a bank lends a dollar to customers for every dollar that it brings in as deposits. But this also means that the bank doesn’t have significant cash on hand for contingencies. A combination of prudence and regulatory requirements suggests that for a traditional bank, the LDR should be around 80-90%. With a business model that relies heavily on traditional loans-and-deposits services, U.S. Bancorp has an LDR figure that appears to be optimal. As for the other banks, the ratio seems to be inversely proportional to the degree of diversification in the business model – the more diversified the bank in terms of offerings, the lower the LDR figure.

The Fed’s ongoing rate hike process has improved the interest rate environment – helping deposits grow at a slower rate than loans. This is in contrast to the rapid deposit growth seen over 2011-2016, when low interest rates led to more cash being parked by individuals and institutions with banks. As higher interest rates will provide investors with more lucrative investment options, this will lead to slower growth in deposits. While loans are unlikely to grow at the rapid pace seen over recent years, a strong economic outlook should keep the demand for fresh loans high. This will result in an overall increase in LDR figures over subsequent quarters.

See full Trefis analysis for U.S. Bancorp | Wells Fargo | JPMorgan | Bank of America | Citigroup

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research