How Will Avon Perform In Q2 2018

Avon (NYSE: AVP) is scheduled to announce its second quarter earnings on August 1. During the previous earnings Avon’s total Revenue increased 5% to $1.4 billion as compared to the same period last year, due to the impact of adopting the new revenue recognition standard required by generally accepted accounting principles in the United States (“GAAP”). Avon’s bottom line largely had remained dampened in Q1 as it experienced continued variability with challenges in key markets, particularly Brazil, where it was facing bad debt, challenges with representative retention, as well as stiff competition from other players. Active Representatives and Ending Representatives declined 4% and 1%, respectively, largely due to declines in Brazil and Mexico. On the brighter side, the company remains on track with the Transformation Plan that targets achieving cost savings of $65 million in 2018, of which $15 million was reached in the first quarter.

Looking ahead in Q2 and remaining 2018, Avon plans to make progress in a number of key areas including delivering competitive representative experience, rigorous performance management, insightful data & analytics, and a relentless focus on execution capabilities.

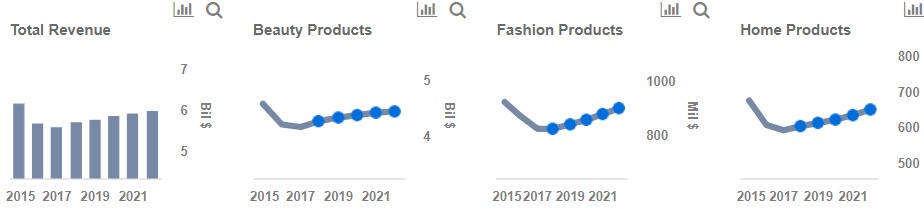

Please refer to our dashboard analysis on Avon.

- How Coty Benefits From Recent Divestment & Deleveraging Plans

- Synergies From The Avon-Natura Merger Could Unlock More Than $1 Billion In Value For Shareholders

- What Does The Avon-Natura Merger Deal Mean For Investors In Avon?

- A Closer Look At Avon’s Global Operations, And What’s In It For Natura

- Key Takeaways from Avon’s Q4 Earnings

- Will Representatives Growth Drive Avon’s Q4 Earnings?

Below we discuss the main focus areas that will likely help Avon in reviving growth in the upcoming Q2 2018 results:

Geographic And Brand Focus – Its revenues rose by 12% y-o-y to $568.4 million in Europe, Middle East & Africa (EMEA), however it was flat in South Latin America at $497.1 million. The company is more than focused on its top ten markets (Brazil, Mexico, Russia, Philippines, the UK, Argentina, Colombia, Turkey, Poland, and South Africa) for most of its growth. The company is also focusing on better representative engagements in these markets. Along with its markets, Avon has also decided to focus on around 40 of its top brands that contribute about 80% of its growth. It has segregated its brands under three tiers: Upper Mass, Mass, and Value. It is also focused on gathering analytical data on each representative’s business and working towards improving their representatives’ experience.

Short Term And Long Term Financial Goals – Enabled by these strategies, the company plans on driving out cost, improving financial resilience, and investing in growth over the next three years. Its long term financial goals include: mid-single digit constant dollar revenue growth and a low double-digit adjusted operating margin.

Digital Initiatives – The company is focusing on digital and e-commerce initiatives. Avon’s social media presence has increased, with it having the third largest fan following among beauty brands. Along with increasing investments on advertisements, the company is shifting many of its campaigns to the digital platform. In our view, this will positively impact its performance as an increasing number of customers are buying beauty products online.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.