Amazon Prime: Why It Matters And How It Impacts Amazon’s Profitability

Amazon (NASDAQ:AMZN) has a dominant market position in the e-commerce industry in North America and is gradually becoming a much bigger threat to traditional retailers than previously anticipated. A recent note published by Cowen & Co. reported that Amazon Prime had increased its household penetration in the U.S. from 20% in August 2013 to 44% in August 2016, surpassing Costco and Sam’s Club’s relatively flat penetration rate of around 30% each.

Why Prime Matters

Amazon’s Prime Members spend more than twice as much on Amazon than non-members and are generally more loyal (95% retention rate), according to an analysis from Consumer Intelligence Research Partners. Given this favorable spending trend, Amazon is focused on retaining its existing Prime Members and growing this base. Offering conveniences such as free shipping, free photo storage and access to a large on-demand video and music library are ways in which Amazon is able to attract members. The retailing giant also recently launched a photo printing service for Amazon Prime and Amazon Drive members, offering affordable prints of digital photos which are shipped via Amazon’s free standard delivery.

- Up More Than 100% Since The Start Of 2023, Where Is Amazon Stock Headed?

- Amazon Stock Outperformed The Q3 Estimates, What’s Next?

- Amazon Stock Is Up 50% YTD, Can It Top The Estimates In Q3?

- Amazon Stock Surpassed The Street Expectations In Q2

- Amazon Stock Is Undervalued

- Amazon Stock To Beat The Consensus In Q1

How Prime Impacts Profitability

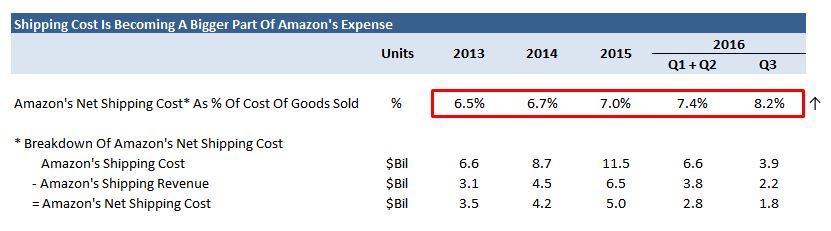

All these efforts are aimed at increasing Amazon Prime membership and building a loyal customer base to drive growth and profitability. In the third quarter ending September 2016, Amazon’s net shipping cost increased to 8.2% of the cost of goods sold, compared to 7% in 2015 and 7.4% in the first half of 2016, owing to the rising number of Prime subscribers who expect faster delivery.

This rapid increase in shipping costs is both good news and bad news because it indicates that sales are rising but it also puts a dent in profits. In the first half of 2016, operating income in North America increased 131% driven by robust rise in Prime subscribers and total sales. However, this growth declined to 37% in Q3 2016 because of higher costs related to acquisition and licensing of digital media content as part of Amazon Video and Amazon Music, and higher shipping expenses (43% growth y-o-y to $3.9 billion).

Considering Amazon Video and Music require high initial investments from Amazon but can generate recurring revenues in the form of premium subscriptions, we expect shipping expenses as a percentage of cost of sales to stabilize in the medium term in North America. Also, as digital media sales (video, music, books) increase as a proportion of total sales, shipping expenses as a percentage of marketplace sales should decline for Amazon in North America going forward.

The Route To Profits

A $99 annual Prime subscription gives subscribers a host of services including some exclusive discounts, free two-day shipping and limited access to free content on Amazon Video, Amazon Music, Kindle e-books and Audible channels. These services help the company attract old and new buyers into its Prime ecosystem. Although these services are likely to help improve sales through subscriptions and increased shopping by users, they are unlikely to help improve profits because of correspondingly higher shipping expenses (for products) and content acquisition costs (for digital content). Therefore, Amazon can improve its profitability either by increasing its annual subscription fee or by incentivizing its Prime users to pay extra for premium video, music and books.

It seems that Amazon is currently comfortable with its $99 subscription fee and it has therefore taken the second route to improve profitability in its marketplace business. Although limited access is part of the $99 annual Prime membership, unlimited access to Amazon Music costs $8 per month, unlimited access to Audible audio books costs $14.95 a month and Kindle Unlimited costs $9.99 a month. In addition, users can rent or buy the latest TV shows and movies through Amazon Video. For instance, one episode of Game of Thrones Season 6 costs $3.99 on Amazon Video and the complete season of ten episodes costs $38.99.

Therefore, even if higher content acquisition costs are hurting profits right now, they are likely to have a lesser impact if Prime subscriptions continue to improve and sales of digital products including video, music and books continue to increase. It is therefore important to focus on the growth in Prime subscribers as much as the growth in Amazon’s operating income, in order to fully understand performance of the company’s marketplace business. By the end of September 2016, Amazon Prime is estimated to have had 65 million subscribers, up from an estimated 54 million at the end of 2015.

Have more questions about Amazon? Please refer to our complete analysis for Amazon

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)