Is ADP’s Stock Overvalued?

ADP (NASDAQ:ADP) has reported 7% annual growth in revenues over the last few years, fueled by higher demand for HR outsourcing and services in that period. HR outsourcing revenues have grown in the mid-teens over the last few years, driven by strong demand for HR outsourcing and related services. Comparatively, payroll processing revenues have witnessed moderate single-digit growth in the same period, as shown below. Low interest rates led revenues from interest on client funds to decline on a year-over-year basis – a trend which could reverse in the future.

According to our estimates, Payroll Processing forms around of our $39 billion valuation for ADP. The Client Funds Interest segment makes up around 30% of ADP’s valuation, and the HR Outsourcing segment makes up roughly 11%. Below we take a look at why we maintain our $86 price estimate for for ADP, which is around 10-12% lower than the current market price.

Steady Performance In 2016, Stable Future Outlook

Keeping up the trend from previous years, much of the growth was attributable to HR outsourcing and other services (or PEO services), which grew at 16% for fiscal year 2016 (ended June) to just under $3.1 billion. ADP’s comprehensive scope of services – including health and welfare benefits services, compliance services, 401k retirement savings plans and worker insurance services for small and medium enterprises – has helped its HR Outsourcing & Services division grow rapidly. Correspondingly, the total number of worksite employees under ADP’s HR division has increased at a CAGR of almost 13% from 2010 through 2015. Similarly, the company reported an almost 12% increase in its total worksite employees to 432,000 by the end of June.

Comparatively, ADP’s payroll processing revenues increased by 4% for the full year, as the company has witnessed a steady 2-3% increase in its payroll clients over the last few years – a trend which continued in 2016 as well. The increase in payroll clients was complemented by a modest 1% price increase leading to a 4% annual growth in revenues.

According to our estimates, ADP’s adjusted EBITDA margin stood at just under 21% in 2015, and has improved slightly in 2016. It should be noted that the key contributor to the EBITDA growth was the corresponding increase in revenue, while the impact of changes in operating expenses is negligible for ADP, as shown below.

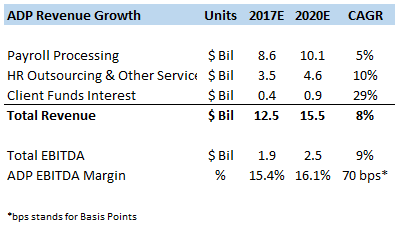

Over the next few years, we forecast ADP to sustain revenue growth in Payroll Processing & HR Outsourcing, as shown below. We forecast mid-single digit growth in Payroll Processing revenues. (Read: Why Payroll Processing Remains Key For ADP’s Long-Term Growth) Additionally, ADP’s HR Outsourcing and Other Services segment should continue to witness strength in its service offerings. We forecast ADP’s total worksite employees to continue to increase, albeit at a slower pace, to over 650,000 employees by 2022.

In addition to the segments mentioned above, ADP could witness strong growth in its Client Funds Interest segment if interest rates pick up in coming years. The Fed has indicated that another interest rate hike is likely in the near term. [1] Since the operating expenses of the Client Funds Interest segment are fixed in nature, revenue growth directly translates to an improvement in margins. As a result, the company-wide EBITDA could grow at a faster pace than revenue growth as shown below.

You can modify the interactive charts in this note to gauge how a change in worksite employees, number of payroll customers or fee charged per client can have on our price estimate for ADP.

See our full analysis for ADP.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- The Federal Reserve looks ready to roll with an interest rate hike in December, CNBC, November 2016 [↩]