ADP Earnings: PEO Services Drive Q4 And Full Year Results

ADP (NASDAQ:ADP) announced its fiscal Q4 results on Thursday, July 28, reporting 8% annual growth in revenue to $2.9 billion. [1] Correspondingly, ADP’s net revenues for the fiscal year ended June stood at $11.7 billion, which was a 7% year-over-year increase.

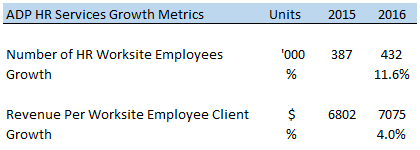

Similar to the previous 6-8 quarters, much of the growth was attributable to HR outsourcing and other services (or PEO services), which grew at 13% for the quarter and 16% for the full year. Over the last few years, Paychex has witnessed double digit growth in HR Outsourcing and Services revenues, which has led to an increase in the contribution of HR Outsourcing and Services to the company’s top line from 17% in 2010 to 26% in 2016. ADP’s comprehensive scope of services – including health and welfare benefits services, compliance services, 401k retirement savings plans and worker insurance services for small and medium enterprises – has helped its HR Outsourcing & Services division grow rapidly. Correspondingly, the total number of worksite employees under ADP’s HR division has increased at a CAGR of almost 13% from 2010 through 2015. Similarly, the company reported an almost 12% increase in its total worksite employees to 432,000 by the end of June.

Comparatively, ADP’s payroll processing revenues increased by 6% for fiscal Q4 and 4% for the full year to $2 billion and $8.2 billion, respectively. The company has witnessed a steady 2-3% increase in its payroll clients over the last few years – a trend which continued in 2016 as well. Similarly, a modest 1% price increase led to a 4% annual growth in revenues.

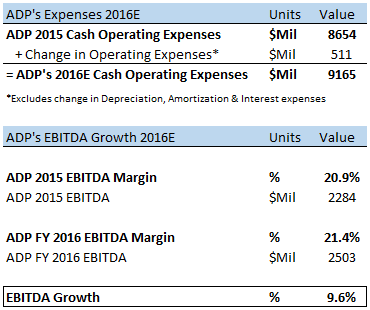

In terms of profitability, ADP reported a 6% increase in cash operating expenses to $9.2 billion for the full year. These expenses do not include non-cash depreciation & amortization and interest expenses. Since the increase in operating expenses was lower than revenue growth, ADP’s adjusted EBITDA margin improved to 21.4% for the full year – up from just under 21% in FY 2015.

For the coming year, ADP’s management expects an 8% growth in net revenues for the full year, with revenues generated from HR outsourcing and other services expected to grow by 15%. Moreover, ADP’s operating profit margin is also likely to expand by about 20 basis points through the year. [2]

See our complete analysis for ADP

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- ADP Reports Fourth Quarter Fiscal 2016 Results, ADP Press Release, July 2016 [↩]

- ADP Earnings Call Transcript Q4 2016, Seeking Alpha, July 2016 [↩]