What To Expect From Microsoft’s Q2 Earnings

Microsoft (NASDAQ:MSFT) reports its Q2 earnings on January 30. The company seems to be firing on all cylinders at the moment, and the stock has increased by nearly 15% over the past week. We will be listening for management commentary on how the cloud business will pan out over the year, integration progress of GitHub and on traction in the gaming cloud.

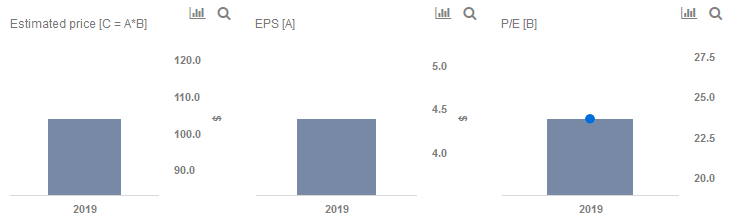

We currently have a price estimate of $104 per share for Microsoft, which is around 15% higher than the current market price. Our interactive dashboard on Microsoft’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Down 14% In The Last Trading Session, Where Is Adobe Stock Headed?

- Down 8% YTD, What To Expect From Adobe Stock In Q1?

- Up 77% Last Year, What To Expect From Adobe Stock?

- Adobe Stock Is Trading Below Its Fair Value

- Adobe Stock Outperformed The Street Expectations In Q2

- Adobe Stock Topped The Consensus In Q1, What’s Next?

What We Will Be Watching

Microsoft’s Q1 beat market expectations, with the company delivering growth across segments. Furthermore, the company also guided for a strong Q2 with a revenue expectation of $31.9 – 32.7 billion (+10-13% y-o-y). Management’s philosophy appears to have moved from simply bundling to delivering valued-based buckets, with the Intelligent Cloud as the underlying platform across technologies. Coupled with the analytics-driven workloads (which fit in well with Microsoft 365 capabilities), the Microsoft juggernaut seems to be going strong, with the growth from xCloud and the Windows refresh cycle allowing for further cash flow stability.

In Q2, we will be looking forward to management commentary around visibility in a relatively weak IT spending environment. In Q1, Microsoft announced its intent to hike prices in the server products and cloud services division, leading to a two percentage point increase in growth (+28% y-o-y). We will also be watching to see if demand was actually inelastic with, which would be indicated by volume growth coming in higher. Also of interest will be any commentary around the competitive picture in the broader Intelligent Cloud space.

Do not agree with our forecast? Create your own price forecast for Microsoft’s Price Estimate by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.