What Is Accenture’s Q1 Outlook?

Accenture‘s (NYSE:ACN) fiscal Q4 revenue and EPS came in ahead of consensus estimates, as did the company’s Q1 revenue guidance of $10.35-10.65 billion. Accenture’s increasing focus on Digital, Cloud and Security Services are likely to help the company show sustained growth going forward.

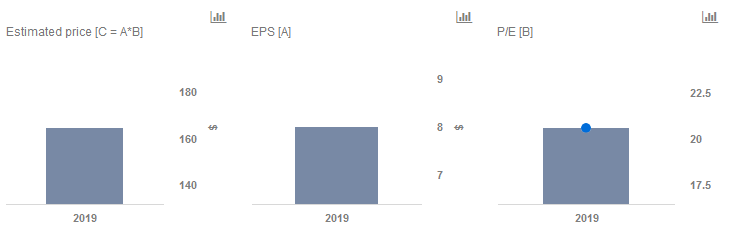

We currently have a price estimate of $165 per share for Accenture, which is around 10% higher than the current market price. Our interactive dashboard on Accenture’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

Accenture’s strength stems from its presence across the consulting and outsourcing markets. The company has been keeping up with the changing demands of the market by investing in market access, product focused acquisitions to supplement its services presence, and developing a platform to derive the benefits of scale. Despite management continuing to see benefits of enhanced growth from its acquisitions and operating leverage, the Accenture management has only guided for 5-8% y-o-y growth for fiscal 2019, with operating margins expected in the range of 14.5% to 14.7% (+10 to 30 basis points y-o-y).

The company’s management attributes its relatively conservative stance to global geopolitical situations such as Brexit, U.S.-China trade disputes and the ensuing currency volatility, as well as Accenture’s own investment in people and platforms. Another factor is the change in accounting standards, which will be more of a one-off. However, the company’s expectation of generating FCF of over $5 billion and returning $4.5 billion speaks well of the company’s business visibility. Another positive has been the fact that management has not seen any spending ‘pull-forward’ due to the tax reform, which again points to the fundamental strength in Accenture’s underlying business.

Going into Q1, we will be watching for any further color on client wins owing to Accenture’s recent acquisitions and the demand environment in light of the evolving macroeconomic conditions.

Do not agree with our forecast? Create your own price forecast for Accenture by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.