Do JP Morgan and Goldman Agree on Apple’s Stock Price?

Apple stock (NASDAQ: AAPL) has seen some volatility this year, driven by declining iPhone demand and the re-escalation of the U.S. trade war with China. Overall, brokerage firms still remain bullish on the stock, with an average price estimate of over $220 per share. In this analysis, we look at how the top brokerage firms view Apple stock, and how their price targets have changed over time.

View our interactive dashboard analysis Apple Price Target and Consensus: Are JPMorgan, Goldman and Morgan Stanley bullish on Apple in 2019?

1. Top Banks are mixed in their views: JPMorgan and Morgan Stanley are ~10% ahead of the market, while Goldman Sachs’ price target is below market at $187.

- JPMorgan is bullish on Apple with a $239 price target, as is Morgan Stanley with a price target of $247.

- Goldman is bearish on the stock, with a target of $187 per share.

- This implies an average price target of $224, ahead of Apple’s current market price.

- Down 10% This Year, Will Gen AI Tools Help Apple Stock Recover?

- Down 5% Over The Last Month, Will Strong iPhone Sales Help Apple Offset Mac Headwinds In Q1?

- After Over A 40% Rally In 2023, Will Antitrust And iPhone Issues Hurt Apple Stock?

- Up 45% Since The Beginning Of 2023, Where Is Apple Stock Headed?

- Up 34% This Year, Will Apple Stock Rally Further Following Q4 Results?

- Will New iPhones Help Apple Stock Offset A China Slump?

2. However, since January 2019, all 3 have raised their price targets for Apple

- The banks have generally grown more bullish on Apple though the year, with Goldman boosting its price target by almost 33%.

3. The multi-year view shows banks moving largely in-sync, though Morgan Stanley has been consistently increasing its target

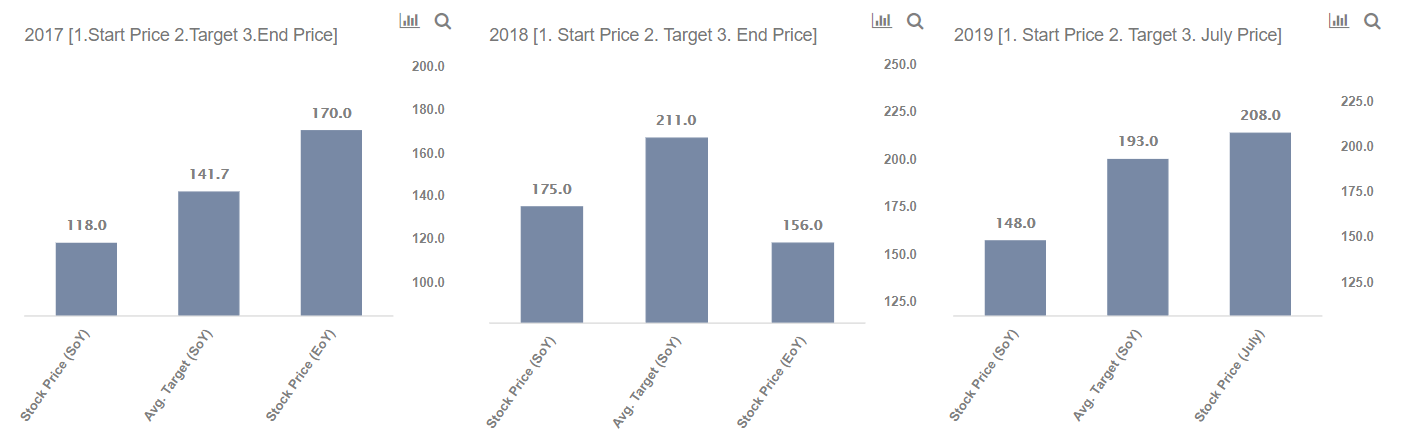

4. Top 3 banks’ consensus target at the start of the year [SoY] correctly predicted the direction of end of year [EoY] stock price for 2017 and 2019 but missed for 2018

5. While the top 3 banks’ consensus prediction wasn’t always accurate, Apple’s reported Revenues and Profits did move in the same direction as the banks’ price targets

Conclusion

- While the top banks may not have accurately predicted Apple’s 1-year stock price, they have largely been correct in terms of direction.

- Overall, with top banks becoming more bullish on Apple over 2019, it might bode well for Apple’s stock and fundamentals.

* We calculate the consensus target for a given year as the average of the first price target issued by each bank for that year.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.