What’s The Impact If Apple’s Products Are Banned By China: An Interactive Analysis

Apple (NASDAQ:AAPL) faces mounting risks in China, its third largest market, amid the re-escalation of the trade tiff between the U.S. and China. While Apple has already been witnessing lower demand in China due to mounting competition and higher prices on its new products, we project that sales could take a further hit due to anti-American sentiment. Separately there is also an extreme scenario that Apple products could be banned in China, as a response to the Trump administration’s ban on Chinese telecom equipment major Huawei. In this analysis, we take a look at how Apple’s Chinese business has been faring and what the outlook could be like. We also provide a scenario (shown in blue) on the potential impact that a ban on Apple’s products in China could have on its EPS and stock price.

View our interactive dashboard analysis on What’s The Impact On Apple If Its Products Are Banned By China? You can also see more of our data for Information Technology Companies here.

How Has Apple’s Chinese Business Trended In Recent Years And What’s The Outlook?

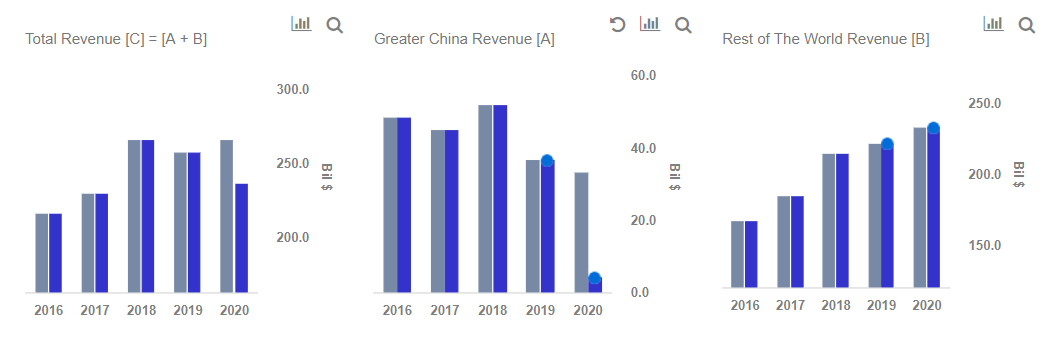

- While Greater China sales (which include Mainland China, Hong Kong, Taiwan) stood at $52 billion in FY’18, they declined by close to 25% over the first two-quarters of FY’19.

- We expect FY’19 sales in Greater China to decline 30%, due to poor uptake of iPhones such as the mid-range XR, the increasing popularity of Chinese smartphones, and the aforementioned geopolitical factors.

- We expect Greater China revenue as a % of overall revenues to drop from about 22% in FY’16 to just about 13% in FY’20.

- Down 10% This Year, Will Gen AI Tools Help Apple Stock Recover?

- Down 5% Over The Last Month, Will Strong iPhone Sales Help Apple Offset Mac Headwinds In Q1?

- After Over A 40% Rally In 2023, Will Antitrust And iPhone Issues Hurt Apple Stock?

- Up 45% Since The Beginning Of 2023, Where Is Apple Stock Headed?

- Up 34% This Year, Will Apple Stock Rally Further Following Q4 Results?

- Will New iPhones Help Apple Stock Offset A China Slump?

What’s The Impact On Apple’s 2020 EPS And Valuation If Its Products Are Banned By China?

Estimating Impact Of A Ban On Apple’s Total Revenues

- If Apple products are banned by China, we estimate that its FY’20 sales would be lower by 11% versus our base case at about $265 billion in total sales.

- However, as its sales in the Greater China segment also includes Hong Kong and Taiwan in addition to the Mainland, we estimate that segment sales will come in at about $4 billion for FY’20.

Impact Of A Ban On Apple’s EPS And Stock Price

- Its also likely the net margins will take a hit, as Apple’s margins in China could be higher than the company average, due to higher pricing and a potentially more favorable product mix.

- Apple’s FY’20 EPS could fall by about 21% versus our base case, in the event of a ban.

- This would translate into a YoY decline of about 15% in EPS.

- Our price estimate for the company would also decline from about $186 per share to about $147 per share.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.