American Airlines Stock Loses 25% Over Coronavirus Fears. Is It Time To Buy?

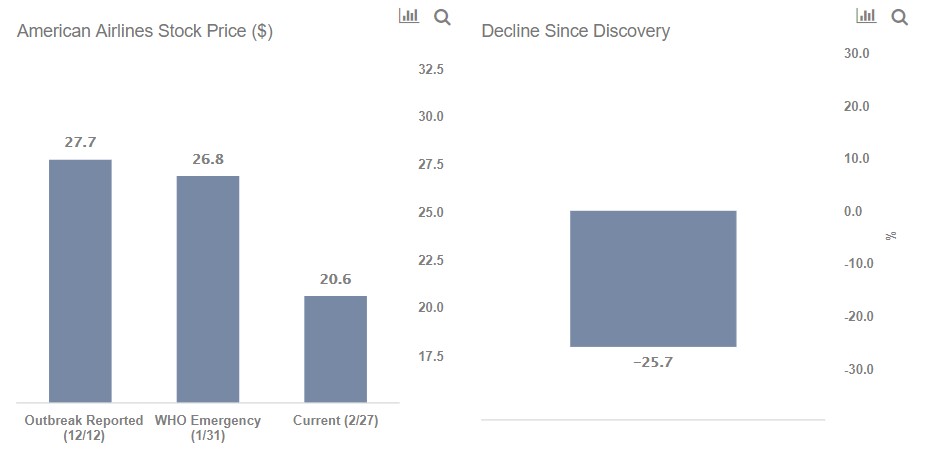

Global markets have reacted strongly to the increase in cases of the novel coronavirus outside of China. Airline stocks have taken a particularly big beating, with American Airlines (NASDAQ: AAL) stock shedding about 25% of its value over the last 4 days.

In this analysis, we compare how American Airlines’ stock reacted to previous epidemics such as SARS (2003) and H1N1 (2009) to understand whether the stock could go lower or if it’s time to get in. Overall, we find that the best time to buy during such outbreaks has historically been just before the disease peaks. While it could be difficult to call a peak for COVID-19, SARS cases peaked roughly 6 weeks after the disease was identified as being meaningful (reported to WHO) and about 18 weeks after it was first detected.

View our complete dashboard analysis on Coronavirus Knocked 25% From American Airlines Stock. Time To Buy?

- Should You Pick American Airlines Stock At $14 After A 6% Fall In A Week?

- With 20% Gains This Month Is Alaska Air A Better Pick Than American Airlines Stock?

- Which Airlines Stock Will Offer Better Returns – American Or United?

- What To Expect From American Airlines’ Q2?

- Will American Airlines Stock Recover To Its Pre-Inflation-Shock Level?

- Pick Either American Airlines Stock Or Its Peer – Both May Offer Similar Returns

How has American Airlines stock reacted to the coronavirus outbreak so far?

How American Airlines Stock reacted to the SARS & H1N1 outbreaks

#1. SARS Outbreak of 2003

Timeline

- 1st Detection (Outbreak in Guangdong, China) Nov 16, 2002

- Identified meaningful (China notifies WHO) Feb 10, 2003

- Peak Spread (Cases peak in Hong Kong) Mar 30, 2003

- Significant decline (Schools re-open in HK, advisories lifted) April 30, 2003

- +3 Months July 30, 2003

#1.1 How Did The Stock Price For American Airlines & Its Rivals React To SARS?

- American Airlines’ stock declined from $7.20 when SARS was first detected to about $3.10 when it was identified to be meaningful.

- The stock fell further to about $2.10 as the disease peaked

- It recovered to levels of $4.50 when the outbreak saw a significant decline and rose further to $9.10 in the following 3 months.

- AAL stock declined 31% between the time SARS was identified as a meaningful threat to the peak phase, while it rose by over 100% as the number of cases dropped. The lowest price over the period of the outbreak was $1.40, on March 12, just before the infection peaked.

To see how American Airlines fared compared to Southwest Airlines and the S&P through the SARS and H1N1 outbreaks, view our dashboard analysis Coronavirus Knocked 25% From American Airlines Stock. Time To Buy?

#2. H1N1 Pandemic of 2009

Timeline

- 1st Detection (First confirmed case in the U.S.) Mar 30, 2009

- Identified meaningful (WHO issues first disease outbreak notice) Apr 24, 2009

- Peak Spread (CDC says H1N1 may have peaked) Nov 30, 2009

- Significant decline (CDC says cases of influenza declining steadily) Dec 19, 2009

- + 3 Months Mar 19, 2010

#2.1 How Did The Stock Price For American Airlines & Its Rivals React To H1N1?

- Americal Airlines’ stock rose from $2.60 when H1N1 was first detected to about $4.80 when it was identified to be meaningful.

- The stock fell to about $3.50 as the disease peaked

- It recovered to levels of $4.50 when the outbreak saw a significant decline and rose further to $7.10 in the following 3 months.

- AAL stock declined 27% between when H1N1 identified as a meaningful threat to the peak phase, while it rose by 30% as the number of cases dropped. The lowest price over the period of the outbreak was $2, on July 20

CONCLUSION

- Based on the above analysis, the best time to BUY during such outbreaks is around when the disease peaks.

- While it could be difficult to call a peak for COVID-19, considering that the cases of new infection appear to be moderating in China but are increasing overseas, it’s worth noting that SARS cases peaked roughly 6 weeks after the disease was identified as being meaningful (reported to WHO) and about 18 weeks after it was first detected.

Additional details about trends in American Airlines stock during SARS (2003) and H1N1 (2009) epidemics are available in our interactive dashboard.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams