Will American Airlines’ FY 2019 EPS Beat Consensus?

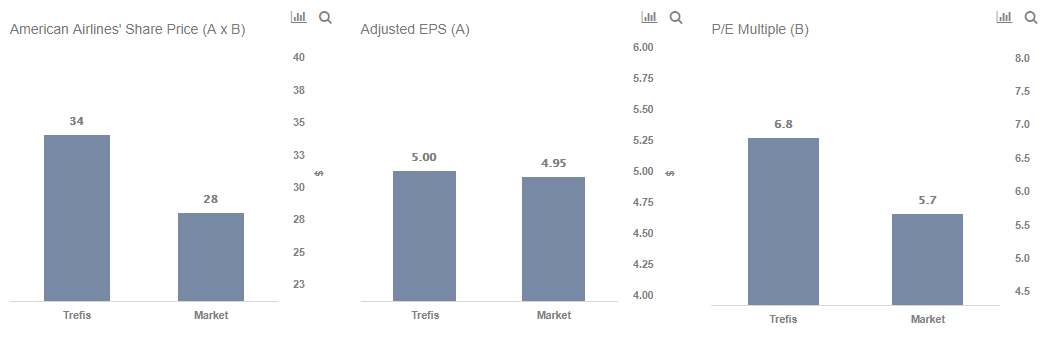

American Airlines (NYSE: AAL) will release its full-year 2019 results on Thursday, January 23. Trefis details expectations from the airline company in an interactive dashboard, parts of which we highlight below. We believe that American Airlines will report stronger-than-expected earnings for FY 2019. We expect American to report total revenues of $45.7 billion (identical to the consensus estimate of $45.7 billion), driven by the company’s passenger division. Also, earnings are likely to be $5.00 (vs. consensus estimate of $4.55), growing by 10% (y-o-y) primarily due to lower fuel costs. Though the U.S. airline industry faced a capacity shortage in 2019, we believe that investors are unduly pessimistic about American Airlines and estimate its valuation to be $34 a share – roughly 20% above its current price of $28.

[1] American Airlines’ Revenues expected to be in-line with the consensus

- The company generates a bulk of its revenues from air ticket sales, which contribute nearly 92% of Passenger revenues.

- Redemption of certain passenger loyalty rewards and other ancillary services such as baggage fees and on-board sales are also recognized as Passenger revenues.

- In 2018, Passenger revenues observed a growth of 4%, primarily due to growing capacity and increasing yield.

- In the first three quarters of 2019, American’s available seat miles had increased by just 0.5% due to the grounding of its 737 MAX aircraft.

- Moreover, a stagnating yield factor (which represents the revenue an airline makes per passenger mile) has been a drag on the revenues, which are expected to grow by just 2.7% (y-o-y) to $45.7 billion for the full-year 2019.

- Should You Pick American Airlines Stock At $14 After A 6% Fall In A Week?

- With 20% Gains This Month Is Alaska Air A Better Pick Than American Airlines Stock?

- Which Airlines Stock Will Offer Better Returns – American Or United?

- What To Expect From American Airlines’ Q2?

- Will American Airlines Stock Recover To Its Pre-Inflation-Shock Level?

- Pick Either American Airlines Stock Or Its Peer – Both May Offer Similar Returns

[2] EPS expected to increase by 10% from $4.55 in 2018 to $5.00 in 2019, driven by lower fuel costs

- After falling sharply in December 2018, crude oil prices have remained relatively stable at $60 a barrel in 2019.

- As fuel expenses are nearly 20% of the operational costs for the company, lower fuel expenses have had a positive impact on the net income margin.

- We expect the company’s EPS to have grown by 10% to $5.00 for full-year 2019.

- Our valuation for American Airlines’ stock stands at $34 per share, driven by an EPS of $5.00 and a P/E multiple of 6.8x

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams