How is American Airlines’ Shaping Up Going Into The First Quarter?

American Airlines (NASDAQ:AAL) American Airlines Group is expected to report earnings on the 26th of April. The airline continues to face various issues for the quarter, mainly due to tepid demand on its domestic and mainline routes, the Airlines has faced issues of quality, and competitors like Delta, have used the opportunity to take away key market share from the airline. Overcapacity is expected to be an issue and this may affect revenue per average seat mile.

We currently have a price estimate of $51 per share, which is higher than the market price. You can use our interactive dashboard American Airlines 2019 to modify key drivers and visualize the impact on American Airlines’ price estimate.

- Should You Pick American Airlines Stock At $14 After A 6% Fall In A Week?

- With 20% Gains This Month Is Alaska Air A Better Pick Than American Airlines Stock?

- Which Airlines Stock Will Offer Better Returns – American Or United?

- What To Expect From American Airlines’ Q2?

- Will American Airlines Stock Recover To Its Pre-Inflation-Shock Level?

- Pick Either American Airlines Stock Or Its Peer – Both May Offer Similar Returns

Key takeaways:

-EPS is expected to come in $0.51 which would be 34% below Q1 2018.

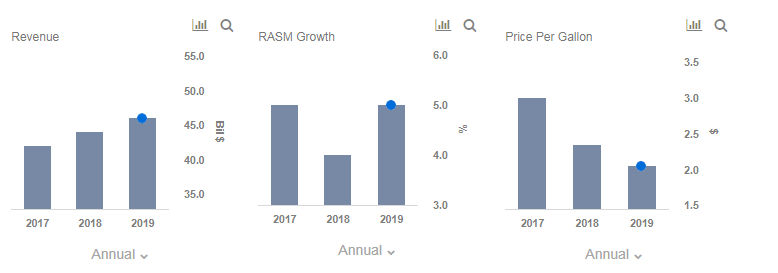

-Revenue is expected to be 2.5% higher at 10.4 billion.

-RASM is expected grow only by 1%, this due to overcapacity as we previously mentioned.

-Average fuel cost is expected to be $2.07 for the quarter.

– The airline continued to focus on the premium segment for the quarter.

With the issues of the 737 max grounded, American Airlines’ revenue and net income is expected to be affected negatively. There is no timeline as to when this issue will be sorted out. We expect the grounded planes to cost the airline $150 million.

With high levels of debt ($24 billion) and a debt-to-equity ratio of 2, the company continues to struggle with cash-flow. We expect these issues to continue during the quarter.

Our estimate remains relatively higher than the market price, but we believe, should American Airlines improve its operational service, increase flight routes, slow down capital expenditure, then the airline during the latter quarters could see its stock rise closer to our estimate.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.