How Is American Airlines Likely To Grow In The Next Two Years?

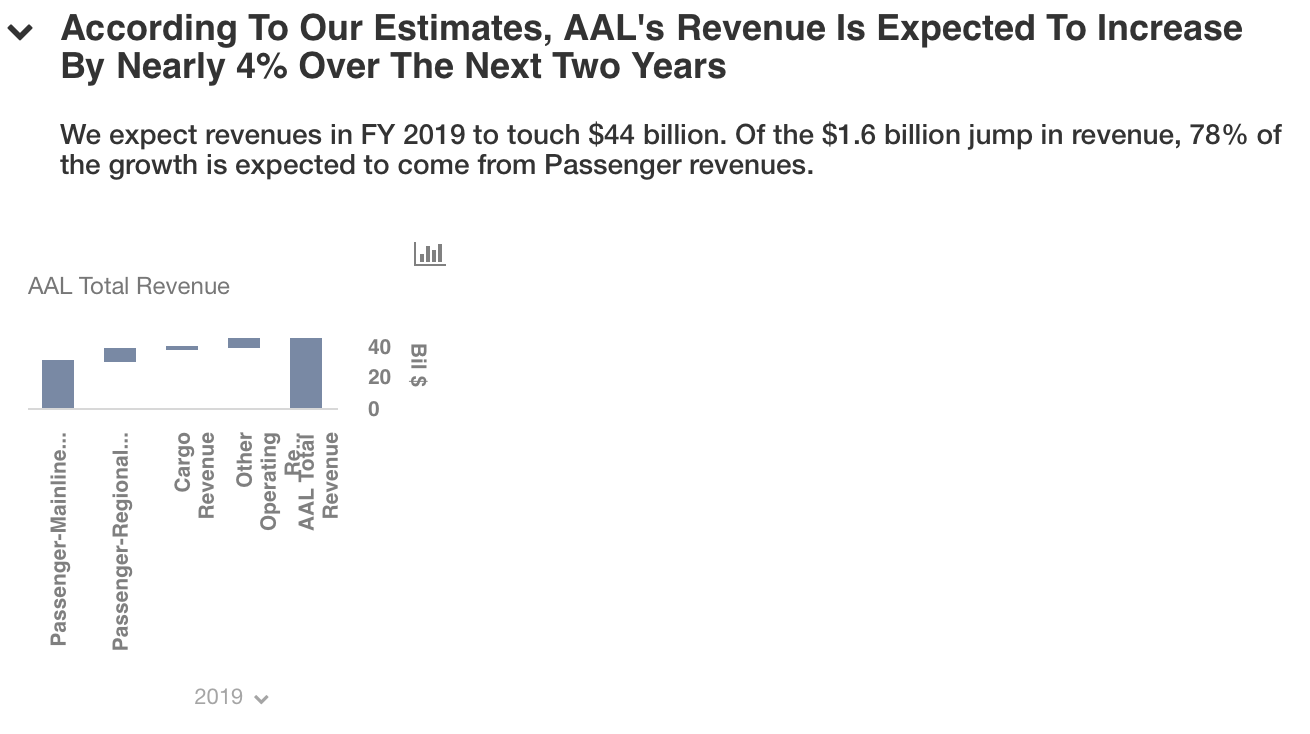

American Airlines (NASDAQ:AAL), one of the largest airlines in the world, hardly needs an introduction. The company, despite many hurdles in the previous year, posted better-than-expected revenues and earnings figures. In general, we expect a steady growth momentum to persist through most of the coming quarters. In this respect, we believe that the company is set to post revenues of about $43.8 billion in FY 2019, at a modest CAGR of 2%.

We have created an interactive dashboard which shows the forecast trends. You can modify the different revenue drivers to see how it will impact the company’s expected revenues.

- Should You Pick American Airlines Stock At $14 After A 6% Fall In A Week?

- With 20% Gains This Month Is Alaska Air A Better Pick Than American Airlines Stock?

- Which Airlines Stock Will Offer Better Returns – American Or United?

- What To Expect From American Airlines’ Q2?

- Will American Airlines Stock Recover To Its Pre-Inflation-Shock Level?

- Pick Either American Airlines Stock Or Its Peer – Both May Offer Similar Returns

The company commands the highest market share in comparison to all its competitors. While this is a good thing overall, it also means that expansion plans are tricky to implement. This has led to relatively smaller increases in revenues across all segments.

That said, we expect Mainline revenues to improve by about 2% over the next few years, while Regional revenues see a jump of almost 10%. This is primarily because it is significantly easier for the company to tap into untouched markets in the U.S., than struggle with increasing the number of flight in already established sectors, internationally. Overall growth in both segments is expected to be augmented by increased demand for flying over the next few years, as the economy continues to improve.

The Cargo segment is quite a small contributor to the overall revenues, however, it is also the fastest growing segment in the company. We expect the division’s revenues to grow by almost 19% over the next two years. Moving to Other, we expect to see revenues increase by almost 4%. The primary component of Other revenue is fees from reservation changes and excess baggage fees charged to customers. Understandably, this does not account for much of the total sales. However, with increased passenger miles, revenues in the division are bound to increase in a similar proportion.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.