American Airlines Q4 Earnings: Shares Plummet On Rising Profitability Concerns

American Airlines (NASDAQ:AAL) reported a pretty decent earnings this time around. The company managed to beat the earnings and revenue estimates by a comfortable margin. Despite this, the company witnessed its stock price plummet post the call on rising concerns over profitability. The airline posted profits to the tune of $258 million in the quarter, which was down by a significant 10.9% year over year. The fall was primarily the product of heavy increases in costs which came in notably higher at about 7% in the quarter. That said, the company is optimistic about its growth prospects in 2018.

The graphs below were made using the Trefis Dashboards.

- Should You Pick American Airlines Stock At $14 After A 6% Fall In A Week?

- With 20% Gains This Month Is Alaska Air A Better Pick Than American Airlines Stock?

- Which Airlines Stock Will Offer Better Returns – American Or United?

- What To Expect From American Airlines’ Q2?

- Will American Airlines Stock Recover To Its Pre-Inflation-Shock Level?

- Pick Either American Airlines Stock Or Its Peer – Both May Offer Similar Returns

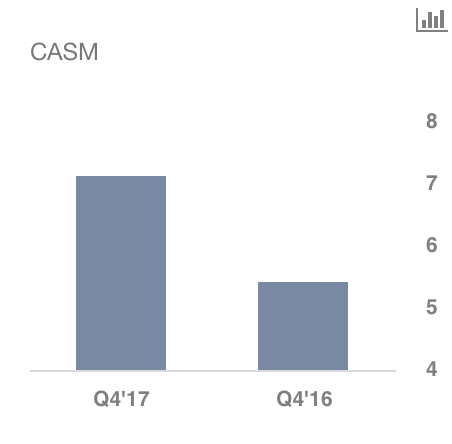

- The biggest concern coming out of the quarter, is as previously mentioned, the rising costs. Fuel costs jumped by a massive $0.34 per gallon. This took a large toll on margins. However, in the same period, the company managed to improve unit revenues at an impressive 5.6% year over year, which was well ahead of management’s initial forecast. This jump in RASM helped offset the effect rising CASM had on the profitability. Margins in the quarter came in at a healthy 7%.

- As mentioned in the previous quarter, American will continue to raise capacity in 2018. This news didn’t go down well with investors that believe the trend of raising capacity across the industry will lead to pricing wars that could massively affect the profits.

- For Q1 2018, the company expects to increase RASM at around 2-4% year over year. That said, it forecasts fuel prices to jump to almost $2.07-$2.12 a gallon, up from around $1.70 per gallon in the same period last year. This rise will more than offset the expected revenue growth. In this respect, non-fuel costs are also set to increase, albeit, at a diminishing rate. The net result is that the company forecasts its pre-tax margin will be around 2-4%, in comparison to 6.7% in Q1 2017.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap