Industry Weakness Continues To Impact Harley-Davidson In Q3 2017

Harley-Davidson (NYSE:HOG) announced its Q3 2017 results on October 17th 2017 and while the company beat analyst expectations for revenues (reported $1.15 billion against a consensus estimate of $964 million), EPS (earnings per share) of $0.40 was in line with consensus estimates. However, these results show a year on year decline of nearly 10% in the company’s revenues and around 40% in the company’s EPS compared to the same quarter in the previous year. This decline is primarily due to weakness in the U.S. motorcycle industry which is likely to continue in the short term. Harley-Davidson is managing this weakness by ensuring that the supply is in line with demand (lower production) and through aggressive cost management.

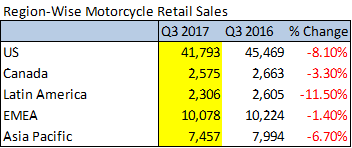

Below is a summary of the company’s performance for Q3 2017:

- With Rate Cuts Around The Corner, Can Harley-Davidson Stock Recover To Over $50?

- Will Harley-Davidson Stock Return To Pre-Inflation Shock Highs?

- Can Harley-Davidson Stock Rise Over 50% To Pre-Inflation Shock Levels?

- What’s New With Harley-Davidson Stock?

- Harley-Davidson Stock Had A Stellar 2022. What Does 2023 Hold?

- What’s Happening With Harley-Davidson Stock?

The decline in motorcycle revenues was due to decreased motorcycle shipments. This decline also impacted the operating margin of the company which decreased by 8 percentage points year on year in Q3 2017. Apart from lower shipments, an unfavorable mix of products and higher manufacturing costs also impacted the margin of the company. However, despite a very competitive market, Harley-Davidson’s market share was up by 0.8 percentage points to 53.1% in Q3 2017.

As the industry slowdown continues, Harley-Davidson expects a 6-8% decline in shipments for 2017 compared to the previous year. With lower volumes, the company expects its operating margin to be lower by 1 percentage point compared to the previous year. As the company looks to navigate this challenging market, below is a summary of some of its key initiatives in Q3 2017:

Strong Model Year 2018 Line Up: Harley-Davidson is working on several new models for 2018, which are geared towards “inspiring the next generation of Harley-Davidson riders.” The company launched two new touring bikes, three new CVO (custom vehicle operations) models, and a sportster which are part of the 14 new high impact motorcycles in the model year 2018 line up.

Pilots To Work On The Rider Development Path: Harley-Davidson believes that motorbike riding is a journey and the company has several training programs available through its dealer network. It is now working on several pilots to identify ways to enhance the rider development path and accelerate creation of riders. This is crucial given that the younger millennial generation consumers have shown a preference for sports and dual purpose motorcycles impacting the sales of Harley-Davidson’s touring and cruiser motorcycles. The most loyal customers of the company are now aging and it is not finding similar demand from the millennial generation. Harley-Davidson plans to build 2 million riders over the next decade and efforts to grow the mature U.S. motorcycle market are critical to meet this goal.

Expanding In International Markets: In Q3 2017 Harley-Davidson’s international performance was also weak. The company is focused on expanding its global reach and brand awareness and is taking several measures to meet this goal. In Q3 2017, the company opened 15 new dealerships in South Korea, Germany, Thailand, and Russia among other countries. In the next four years the company plans to open 100 more stores in Asia beginning with China, India, and Malaysia.

We will be updating our model for Harley-Davidson based on these results, which can impact our price estimate for the company.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)