Why Are Shell’s Upstream Operations More Important Than Its Downstream Operations?

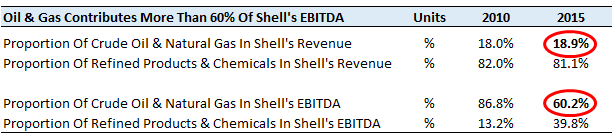

Royal Dutch Shell Plc. (NYSE:RDSA) is an independent oil and gas company operating both in the upstream and downstream segments of the industry. The company’s downstream, or refining operations, account for over 80% of its revenue. However, these operations have very low EBITDA margins, and consequently make up for very little of the company’s profits. On the contrary, Shell’s crude oil and natural gas operations contribute less than 20% of its sales. Yet, they delivered over 60% of the company’s profits in 2015, despite the commodity downturn in the industry.

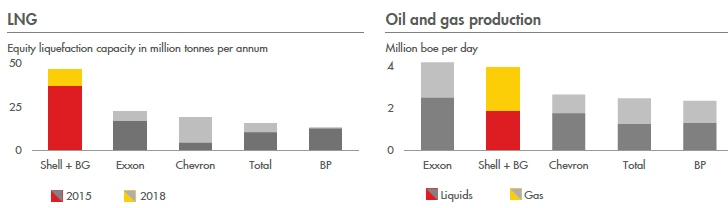

As per the Shell’s latest Capital Markets Day 2016, the company anticipates the global oil and gas demand to double between 2000 and 2050. As a result, the company is focused on growing its oil and gas operations in the future by investing in high-quality low costs assets. In this direction, the company acquired the BG Group (LON:BG) in February of this year. With the completion of this transaction, Shell is expected to become the world’s largest producer of liquid natural gas (LNG), taking over the title from ExxonMobil Corp. (NYSE:XOM).

Source: Shell Capital Market Day 2016

Since Shell is highly optimistic about the growth in the oil and gas demand, we show below how Shell’s upstream operations are more critical for the company than its downstream operations.

Have more questions about Royal Dutch Shell? See the links below:

- How Much Value Will The BG Group Acquisition Add To Royal Dutch Shell?

- By What Percentage Can Royal Dutch Shell’s Revenues Grow Over the Next Five Years?

- What’s Royal Dutch Shell’s Revenue & Earnings Breakdown In Terms of Different Products?

- What’s Royal Dutch Shell’s Fundamental Value Based On Expected 2016 Results?

- How Is Royal Dutch Shell’s Revenue & EBITDA Composition Expected To Change in 2016?

Notes:

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap