Zynga, With A Tough 2013 In Review, Looks Ahead

The year 2013 was a volatile one for Zynga (NASDAQ:ZNGA) as the company went through a significant strategic and management transition and terminated some of its well known games. Revenues and profits continued to slide as the user base shrank. The only silver lining was that the company’s key franchises Farmville, Farmville 2 and Zynga Poker continued to lend support. Going forward, Zynga will primarily focus on mobile gaming and further development of its own gaming platform. Under the new leadership, the company is confident that it can reinvent itself and bounce back by bringing more stability and predictability to its business model. In this analysis, we will discuss key developments for Zynga in 2013 that will essentially shape its strategy for the next year.

Our price estimate for Zynga stands at $3.33, implying a discount of about 15% to the market price.

Check out our complete analysis of Zynga

Operating Metrics Continued The Unfavorable Trend

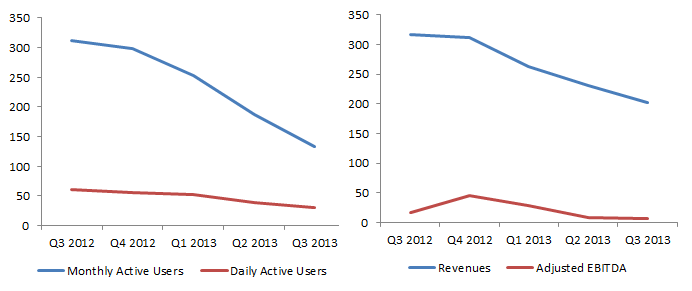

Zynga faced a sharp decline in several of its operating metrics in 2013, including the number of monthly active users, the number of daily active users, revenues and adjusted EBITDA (earnings before interest, taxes, depreciation and amortization). This resulted from the continued decline in popularity of its games, strained ties with Facebook (NASDAQ:FB) and closure of some under-performing titles in the second quarter. For the full year 2013, we expect Zynga’s revenues to be down by roughly 30% as compared to 2012.

(Active User count in million, Revenue/EBITDA in $ million)

(Active User count in million, Revenue/EBITDA in $ million)

As a result of the strategic shift towards introducing fewer but better titles, and to control its operating costs, the company discontinued The Ville, Empires & Allies, Dream Zoo and Zynga City on Tencent in Q2 2013. In mid 2013, it also announced a reduction of its workforce by around 18%, producing a reduction in force of approximately 520 employees for an estimated $70-$80 million in pre-tax savings for the company. Given the sustained period of duress for the social gaming giant, there was a management shake-up as well.

Strategy Shift With Management Shake-Up

Zynga’s stock gained around 20% over a few days following the announcement of Don Mattrick as new CEO. Mattrick has a great track record in heading Microsoft’s (NASDAQ:MSFT) Xbox division as well as Electronic Arts (NASDAQ:EA), and could offer a fresh perspective and help the company in managing its costs better.

Zynga operates in the social gaming space and its products (games) are directed at casual gamers. The nature of the business is such that the customers tend to be fickle, and it becomes necessary to launch new games frequently to compensate for the decline in the user base of previously successful games. This is not an easy task and requires a great deal of innovation and effort. Zynga’s recent quarterly results suggest that the company is struggling and the new games haven’t attracted many users.

As a result, the company is shifting its focus towards mid-core games and the new CEO is on-board with it. These games tend to be more engaging and sustainable as they combine the engagement level of a core game with the learning curve of a casual game. This can potentially allow for retention of a large user base while promoting in-game purchases as the games are designed to be more engaging and users are likely to pay to upgrade, rather than drop off once the free-play scenarios are completed. Zynga launched Battlezone in the second quarter of 2013, which marked its foray into action RPG (role playing game).

Real Money Gaming Ambitions Didn’t Pan Out As Expected, But Opportunity Remains

Zynga rolled out real-money games ZyngaPlusPoker and ZyngaPlusCasino in the U.K. in early 2013. [1] It tried to do something similar in the U.S. before dropping the plan and sticking to regular social gaming. While that was certainly a setback, the global market for real money gambling is significant and Zynga can add substantial value to its stock if it can establish itself in this market internationally.

According to the management of Betable, a gambling platform, the online gambling market outside the U.S. is worth more than $32 billion. [2] Gambling research group H2 Gambling Capital estimates that the global online gambling market stood at 21.73 billion euros or 19 billion pounds in 2012. [3] The research firm further expects this market to grow by 30% over the next three years. While Zynga has already launched in Europe, it may want to expand to China later on. China’s online gambling market is expected to grow to close to $12 billion in 2013. This may not be surprising as Macau, which is a special administrative region of China, is already the biggest casino market in the world.

Zynga can make a big difference to its business if it can tap this market successfully. It appears that the global online gambling market could reach $40-45 billion in the next five years, and even if Zynga can grab 1-2% share of this market, it could add additional $400-$900 million in revenues. This translates into upside of about 20-30% to our price estimate. However, the company will have to deal with competition from gaming incumbents such as Caesars Entertainment, which already operates online gambling services in Europe and has bought social and mobile game maker Playtika.

Understand How a Company’s Products Impact its Stock Price at Trefis

Notes:- Zynga Rises on Real-Money Gambling in U.K.: San Francisco Mover, Bloomberg, Apr 3 2012 [↩]

- Big Fish Casino Raises The Stakes On iPhone With Real-Money Gambling, TechCrunch, Aug 16 2012 [↩]

- Probability looks at U.S. alliances as online gambling gathers steam, Reuters, Apr 18 2013 [↩]