Exxon Q4 Earnings: Upstream Production & Downstream Earnings Up, Company Focuses On Spending Cuts As Low Oil Prices Hurt Price Realizations

Exxon Mobil (NYSE:XOM) released its 2015 fourth quarter and full year earnings report recently. [1] Talking about some of the positives for Exxon, increased upstream production coupled with significantly improved downstream margins were able to partially offset the impact of lower oil prices on the company’s overall performance. However, the low crude oil price environment continues to weigh significantly on the company’s upstream operations. Benchmark crude oil prices declined sharply in 2015 due to rising supplies and falling demand growth estimates, and we do not expect any significant recovery in the near term. Consequently, Exxon will continue to operate in a challenging environment for the next few quarters. The company is also taking measures to reduce its capital spending and share buybacks in order to be able to better steer through this commodity trough.

Our price target for Exxon Mobil stands at $84, implying a close to 15% premium to the market.

See Our Complete Analysis For Exxon Mobil

- Rising 21% This Year, What Lies Ahead For Exxon Stock Following Q1 Earnings?

- Down 9% Since The Beginning of 2023, What Should You Expect From Exxon Mobil Stock?

- Will Exxon Mobil Stock Trade Higher Post Q2?

- What’s Happening With Exxon Mobil Stock?

- Exxon Mobil Stock Likely To Trade Lower Post Q4

- What To Expect From Exxon Mobil’s Stock Post Q2?

Exxon Mobil Ramping Up Upstream Production

Exxon Mobil’s total upstream production during 2015 jumped around 3.2% to be just shy of 4.1 MMBOED (million barrels of oil equivalent per day). [2] The company’s upstream production has remained relatively flat in the last decade, decreasing marginally from 4.21 MMBOED in 2004 to 3.97 MMBOED in 2014. Most of the large integrated oil and gas players have been unable to significantly improve upstream production during this time in the face of natural field declines. However, going forward, Exxon expects to ramp up its net upstream production to approximately 4.3 MMBOED by 2017 as it progresses on its plan to add roughly 0.8 MMBOED (assuming an average 4% natural decline in production every year) of new production between 2014 and 2017. [3] The company is banking on a number of new project start-ups to achieve this target. Exxon Mobil initiated six major project start-ups in 2015 which helped ramp-up production, and further anticipates six more major project start-ups this year to further boost production.

Upstream Realizations Batter Earnings, Company Focuses On Reducing Spending

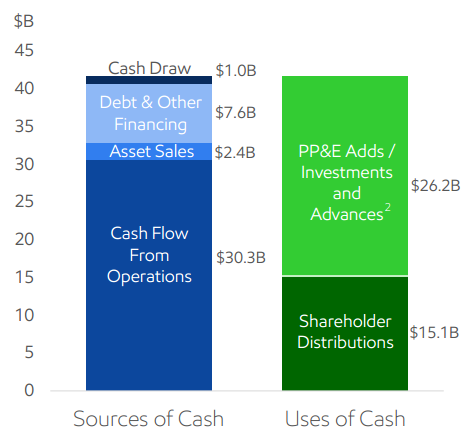

The extended period of low crude oil prices has hurt Exxon Mobil’s upstream operations in 2015. Even though the company has increased daily hydrocarbon production, Exxon Mobil’s average price realized per barrel from liquids for the year dropped drastically from $97 in 2014 to just above $45 in 2015. [2] Resultantly, the company’s 2015 full year upstream earnings fell 74% y-o-y, with the loss due to realizations emerging as the single largest contributor to the massive decline. Brent crude oil spot price averaged close to $52 for the full year 2015 and is currently hovering around the $35 mark. The abundant supply of oil coupled with slower demand growth essentially means that the low energy price environment will continue to persist in the near term. Exxon Mobil’s cash flows from operations amounted to $30.3 billion in 2015, which were not enough to cover cash outflows (capital investments + shareholder distributions) of $41.3 billion.

Cash outflows exceeding cash from operations has been a common occurrence in all 3 earnings updates for integrated oil majors covered by Trefis so far – Exxon Mobil, Chevron (NYSE:CVX), and BP Plc. (NYSE:BP). If the price realizations continue to stay at these depressed levels for longer periods and cash outflows continue to exceed inflows, these companies will find it extremely hard to sustain their dividend programs without resorting to external borrowing. In the wake of outflows exceeding inflows, Exxon Mobil has made a conscious effort to reduce spending. The company’s capital expenditure for 2015 amounted to $31.1 billion, a close to 20% reduction over the prior year. [4] Exxon Mobil plans to continue reducing its capital expenditures during the near term, and aims to reduce 2016 capex to around $23 billion, $8 billion less than 2015 levels. The company also generated cash through divestment of assets worth $2.4 billion last year. Exxon Mobil is also cutting back on its share buyback program. Reuters reports that the company, which spent about $210 billion over the past 10 years buying back stock, has suspended its buyback program and will only carry out buy backs to offset dilution as opposed to returning cash to shareholders. [5]

Downstream Margins Continue To Improve

Exxon Mobil’s downstream margins have improved in the recent past because of the improvement in the global refining environment in general, and increased refinery optimization by the company. Exxon’s regular divestment of its non-core assets has also helped as it has reduced the company’s exposure to less profitable downstream assets. Higher refining margins had propped up Exxon’s downstream operations during the first nine months of the year and that trend continued during the fourth quarter as well. Downstream U.S. GAAP earnings for the full year have amounted to $6.56 billion, a more than 115% jump over the prior year period. [2] This is an impressive result considering both downstream product sales and capacity (refinery throughput) have been down marginally during the same period. Going forward, we expect Exxon’s downstream margins to continue to improve in the near term since we believe that the company will continue to obtain significant efficiency improvements in its refinery business.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes:- ExxonMobil Earns $16.2 Billion in 2015; $2.8 Billion During Fourth Quarter, February 2, 2016, Exxon Mobil News Release [↩]

- Exxon Mobil’s SEC Filings [↩] [↩] [↩]

- ExxonMobil Adds New Production; Continues Long-Term Capital Focus and Investment Discipline, March 4, 2015, Exxon Mobil News Release [↩]

- Exxon’s SEC Filings [↩]

- Exxon, tops in stock buybacks, now saving its cash, February 2, 2016, Reuters [↩]