Wal-Mart’s Plan To Invest Heavily Caused The 10% Fall In The Stock

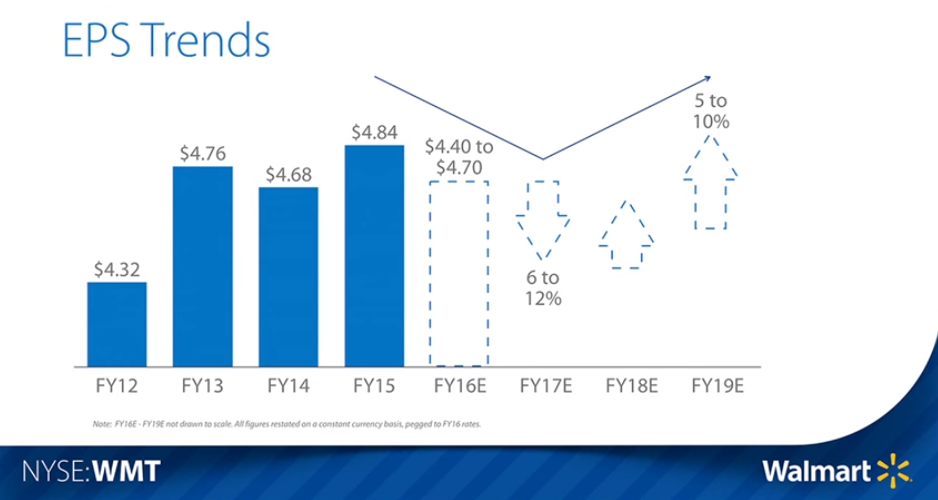

On October 14th, WalMart (NYSE:WMT) held its 22nd annual investor conference where it shared its long-term strategy to transform into an omni-channel retailer, more importantly, the first to do on such a huge scale. The management stressed on the need to invest now to grow in the future, in the light of the shift in power from brick-and-mortar stores towards online retailers, in the recent past. While Wal-Mart has been clear about this strategy for quite some time now, the extent of earnings decline in the near term and the three-year long journey back to current earnings levels, per the company’s guidance, is what we believe is behind the broader disappointment.

This resulted in a fall in WalMart’s stock price by more than 10% in the last three sessions. Below, in this article, we expand on the areas WalMart plans to invest in and how those investments will drive future growth at the $190 billion company.

- Where Is Walmart Stock Headed Post Stock Split?

- Up 7% Already This Year , Where Is Walmart Stock Headed Post Q4 Results?

- Up 18% This Year, Will Walmart Stock Continue To Grow Past Q3?

- Can Walmart’s Stock Trade Lower Post Q2?

- Walmart Stock Likely To See Little Movement Post Q1

- Walmart Stock To Trade Lower Post Q3 Results?

See our complete analysis for Wal-Mart

Investment In People

In February this year, Wal-Mart announced that it would raise minimum wages for its employees from the federal minimum of $7.25 per hour to $9 per hour and further to $10 an hour by February next year. This has resulted in a significant increase in SG&A expenses in recent quarters, which the company is trying to compensate by demanding better prices from its suppliers. In fact, the management attributes about 75% of the expected fall in earnings in FY17 to higher wages. Putting costs aside, the benefits that Wal-Mart expects to realize from this investment are significant.

Sales associates and store managers now play a more important role on the sales floor than being confined to a store’s backroom, paying off in the form of better customer experience. This trend can be observed across multiple brick-and-mortar players as they attempt to improve customer engagement, which we discussed in another recent article. Moreover, WalMart’s management says that a better customer experience is likely to lead to higher store traffic, bigger basket sizes and eventually higher comps sales growth. This is not surprising because with the level of price competition seen in the retail industry, low price is almost a given and, naturally, service is likely to become the key differentiating factor.

Investment In Technology

Through the years, saving money for customers has been the central focus at WalMart. But, things have changed with the emergence of online retailers and the promise of low price has become commonplace. Therefore, WalMart is now shifting its focus to also save time for its customers by building a seamless multi-channel shopping experience. Options like order online and pickup in-store are initiatives that are aimed at solving the time problem.

What makes the opportunity even more enticing is the spending trends among customers who use multiple channels while shopping. According to the company, an average store-only customer spends approximately $1,400 a year at WalMart, compared to $200 among online customers. The real opportunity, however, lies with the population of customers that shop through multiple channels, who spend a whopping $2,500 a year. It is this opportunity that the company is pursuing through its continued investments in technology.

From a total of $0.7 billion in capital expenditure on eCommerce and digital initiatives in FY15, the spending will increase to a projected $1.1 billion in FY17. The company expects operating margins to decline as a result of these expenditures until FY17, after which margins are expected to recover to the current level by FY19 and remain stable thereafter. Despite the short-term downside, we believe this period of high capex, that is atypical of a mature firm, is critical for the company to prepare itself for the years ahead.

As CEO Doug Mcmillon rightly puts it, “This is a growth company. It just happens to be a really large growth company.”

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap