Is A Turnaround In The Cards For United Continental?

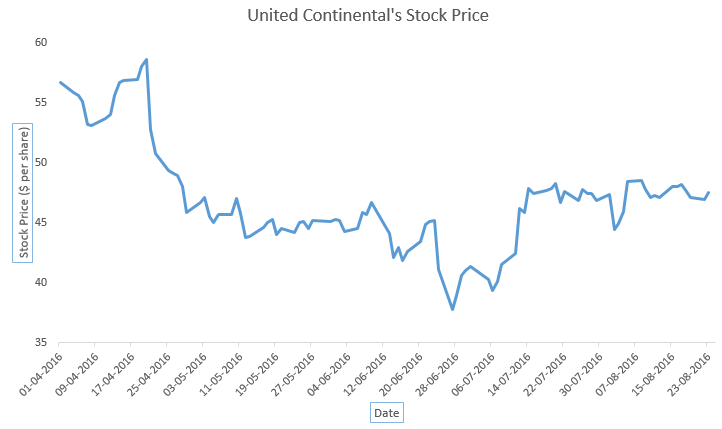

United Continental Holdings (NYSE:UAL) has been in the doldrums for quite some time now. It has witnessed currency headwinds resulting in pressure on unit revenues, causing its international revenue to decline sharply. Further, the gradual recovery in oil prices has also pulled down its operating margins in the last quarter. However, the major blow that has rocked United’s boat is the frequent changes and scandals that its senior executive body have faced over the last one year. This has not only left investors wary of the company and its capabilities, but has also raised a question on the carrier’s ability to perform operationally.

Senior Management Shake-Up

To give some background, United’s President and Chief Executive Officer (CEO), Jeff Smisek, along with two other senior officials, were forced to step down due to a federal investigation questioning their connections with the Port Authority of New York and New Jersey in September 2015. Following this development, United’s stock price dropped drastically, indicating the unrest among investors. As a result, Oscar Munoz was named the new CEO, tasked with the mammoth work of turning around the under-performing airline. However, a month into his role, Munoz suffered a heart attack causing him to return to full-time work only in March 2016. On his return, he had to confront a proxy battle, which owing to his excellent tactics ended in an agreement, overhauling the composition of United’s board.

- Spurred By Stellar Earnings, Can United Airlines Holdings Stock Extend Its Run?

- United Airlines Holdings Stock Looks Set For A Come Back

- Down 13% Last Week, Can United Airlines Holdings Stock Bounce Back?

- Is United Airlines Stock On The Move?

- Company Of The Day: United Airlines

- Will United Airlines Stock Rise After Recent Correction?

Munoz’s Achievements So Far

Since his appointment, Munoz has managed to improve United’s on-time performance and won back some crucial high-spending business travelers. These are important developments for an airline which had left many of its passengers disgruntled after numerous episodes of technical glitches post its merger with Continental in 2010. Further, the CEO was able to successfully maneuver the ratification of two important labor agreements with technicians and flight attendants, extending their contracts and allowing the laborers from United and Continental to finally work together.

However, the gradual recovery in oil prices has weighed on United’s operating margins in the last quarter. In addition, the airline’s position is being challenged by other legacy carriers such as Delta and American who have been restricting their capacity growth to turn their unit revenues (PRASM) positive by end of this year. Also, the Chicago-based airline is facing competition from low-cost carriers such as JetBlue, and Alaska Air, who are relentlessly expanding their existing capacity.

Thus, in a recent and an unexpected move, Munoz appointed Andrew Levy to serve as the new Chief Financial Officer (CFO), and Julia Haywood as the new Chief Commercial Officer (CCO). This news is widely being seen as a positive for the airline due to the Levy’s credibility in the industry, who single-handedly transformed the Allegiant Travel Co. into one of the world’s most profitable carriers.

The Path Forward

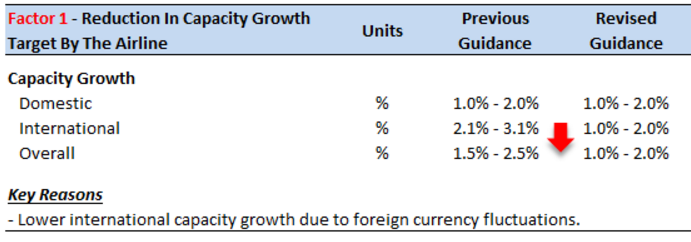

In June this year, CEO Munoz said that he was reviewing United’s operations to understand the routes and hubs that are profitable for the company. On the basis of this review, we can expect the company to add capacity to strengthen its best performing markets, including domestic hubs in San Francisco, Newark, Houston, Denver, and Chicago, and an Asia-Pacific presence that surpasses many of its peers, while lowering its capacity in the international markets. In line with this, United has reduced its 2016 capacity growth target by 0.75% since the beginning of the year.

Revision In Capacity

(Between January’16 To June’16)

Delta and JetBlue recently announced plans to expand their services in Boston and other Caribbean routes to establish their foothold on these crowded and busy trans-continental routes. However, we haven’t heard much in terms of expansion plans from United. In order to come out of the rut it finds itself in, it will be important for the company to ensure it remains competitive in the face of falling unit revenues and low profit margins, despite the windfall from low oil prices.

If the airline does not work towards improving its operational performance and overall perception in the market in the near future, it may become difficult for the world’s second largest airline to catch up with its peers. While it remains to be seen what the new leadership will bring to the table, we foresee a tough road ahead for United.

Have more questions about United Continental (NYSE:UAL)? See the links below:

- United Witnessed A Decline In Q2’16 Earnings, Despite Substantial Fuel Cost Savings

- United Continental Q2’16 Earnings Preview: Higher Oil Prices & Declining PRASM To Weigh On Results

- Here’s Why We Have Revised United Continental’s Price Estimate To $52 Per Share

- Lower PRASM And Higher Tax Bill Caused United Continental’s 1Q’16 Earnings To Drop Despite Huge Fuel Cost Savings

- Currency Headwinds To Offset United Continental’s Fuel Cost Savings For 1Q’16

- How Will United’s Equity Value Be Impacted If The Crude Oil Prices Rebound To $100 Per Barrel By 2018?

- How Will United’s Equity Value Be Impacted If The Crude Oil Prices Average At $50 Per Barrel In 2018?

- How Will United’s Revenue And EBITDA Grow Over The Next Five Years?

- How Important Is United’s International Division For Its Overall Equity Value?

- What Is United’s Fundamental Value Based On 2016 Estimated Numbers?

- Why We Think United Continental Is Worth $65 Per Share?

- What Drove United’s Revenue And EBITDA Growth Over The Last Five Years?

- How Has United’s Revenue And EBITDA Composition Changed Over The Last Five Years?

- What Is United Continental’s Revenue And EBITDA Breakdown?

- How Has United Continental Utilized Its Cash Flows Over The Last Three Years?

- How Have Plummeting Crude Oil Prices Impacted United Continental’s Operating Margin?

Notes:

1) The purpose of these analyses is to help readers focus on a few important things. We hope such lean communication sparks thinking, and encourages readers to comment and ask questions on the comment section, or email content@trefis.com

2) Figures mentioned are approximate values to help our readers remember the key concepts more intuitively. For precise figures, please refer to our complete analysis for United Continental

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap