Q3 Earnings: Twitter To Cut 9% Jobs As Revenue Growth Continues To Slow

Twitter (NYSE:TWTR) released weak third quarter results on Thursday, and said that it would cut 9% of its workforce or about 350 people in an effort to cut costs and inch closer to profitability. In the third quarter, the company’s total revenue increased 8% year-over-year (y-o-y) to $616 million on the back of 6% growth in advertising revenue and 26% growth in its data licensing business. The company’s operating loss declined by 26% to $78 million and net loss declined by 22% to $103 million on the back of a 15% decline in R&D costs. This translated into adjusted earnings of 13 cents per share, which was 2 cents higher than the analyst consensus estimate for this quarter.

Twitter’s average monthly active users (MAUs) grew just 3.3% y-o-y to 317 million in Q3 2016, but the company was enthused with growth in its daily active users (DAUs). In the quarter ending September 2016, Twitter’s DAUs increased at 7%, compared to 5% in Q2 2016 and 3% in Q1 2016.

Twitter’s average monthly active users (MAUs) grew just 3.3% y-o-y to 317 million in Q3 2016, but the company was enthused with growth in its daily active users (DAUs). In the quarter ending September 2016, Twitter’s DAUs increased at 7%, compared to 5% in Q2 2016 and 3% in Q1 2016.  The company’s struggle to grow its active user base has been the primary investor concern for the past six quarters, and that is unlikely to change in the near term. However, with the company redirecting its focus from user expansion to profit generation, the appropriate metric in focus is likely to become user engagement (DAUs/MAUs) and revenue-per-user going forward.

The company’s struggle to grow its active user base has been the primary investor concern for the past six quarters, and that is unlikely to change in the near term. However, with the company redirecting its focus from user expansion to profit generation, the appropriate metric in focus is likely to become user engagement (DAUs/MAUs) and revenue-per-user going forward.

Revenue Growth Driven By Video Ad Engagements

Twitter’s overall revenues rose by 8% y-o-y to $616 million during Q3 2016. Advertising revenue increased by 6% y-o-y and just 2% over the prior quarter to about $535 million. This was primarily driven by a 91% y-o-y increase in the number of ad engagements due to growth in auto-play video ads. However, the average cost per ad engagement dropped by 44% y-o-y as the cost per view of auto-play video ads is significantly lower than click-to-play ads.

Video consumption has been growing tremendously over the past few quarters on Periscope as well as on the Twitter platform with the launch of auto-play videos. Interestingly, Twitter is shutting down its 6-second video app Vine, likely to focus more on its core product of text tweets and live streaming. (Also read What’s Next For Twitter?)

Stock-Based Compensation: On The Decline?

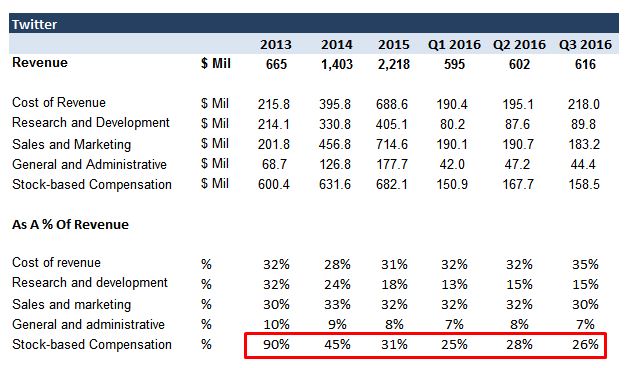

Twitter has not been able to turn a profit in its history and one of the primary reasons for that has been its high stock-based compensation expenses. It is fairly standard for tech companies to partially compensate their employees in the form of stock options both to save cash and incentivize loyalty by tying a part of employee compensation with the company’s fortunes. However, such compensation expenses gradually decline as a share of revenues as the company grows and matures. This hasn’t happened for Twitter as swiftly as shareholders would have liked.

In fact, Twitter ranks second among the larger tech companies (annual revenue > $1 billion) in terms of stock-based compensation expenses, which were equal to about 26% of the company’s total revenue in the first nine months of 2016. [1] Although they have consistently declined over the last three years, they are still quite high compared to companies such as Facebook and Salesforce, whose stock-based compensation expenses are currently about 16% and 9% of revenues, respectively. Going forward, Twitter will look to bring its stock-based compensation expenses down to around these levels, and the company’s plan to reduce its workforce by 9% by next year seems to be a step in this direction.

In fact, Twitter ranks second among the larger tech companies (annual revenue > $1 billion) in terms of stock-based compensation expenses, which were equal to about 26% of the company’s total revenue in the first nine months of 2016. [1] Although they have consistently declined over the last three years, they are still quite high compared to companies such as Facebook and Salesforce, whose stock-based compensation expenses are currently about 16% and 9% of revenues, respectively. Going forward, Twitter will look to bring its stock-based compensation expenses down to around these levels, and the company’s plan to reduce its workforce by 9% by next year seems to be a step in this direction.

Have more questions about Twitter? Please refer to our complete analysis for Twitter

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes:- Why Twitter Is Actually a Media Company, WSJ, Oct 16 2016 [↩]