Why We Lowered Our Twitter Price Estimate By 10%

Twitter (NYSE:TWTR) reported mixed Q1 2016 results last month, with adjusted earnings per share beating market expectations but revenue guidance falling far short of analyst consensus estimates. The company’s disappointing sales growth and guidance was attributed to lackluster user growth in the quarter. Its monthly active user growth was essentially flat in the U.S. in Q1 2016, compared to 3.3% in full year 2015 and 20% in full year 2014.

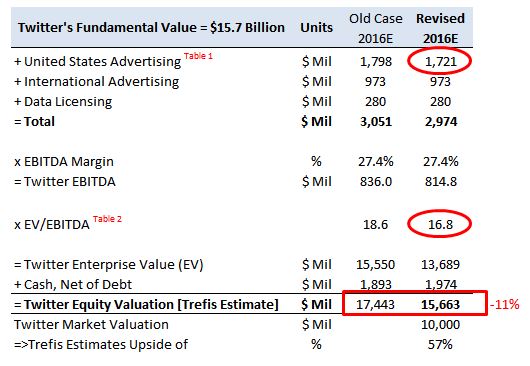

Our estimates for the company’s valuation had assumed a moderate turnaround in its user addition statistics as well as user engagement levels in the first quarter. With the results falling short of our expectations, we have slightly lowered our forecasts for Twitter’s U.S. user engagement levels in the 2016-2020 period, resulting in lower future free cash flows in the division and subsequently lower enterprise value for the company, as illustrated below:

Have more questions about Twitter? See the links below.

- Can Periscope Become The Pillar of Twitter’s Growth?

- What Is Twitter’s Ad Revenue Opportunity From Passive Users?

- The Key Downside Scenarios For Twitter’s Stock

- Twitter Tests New Timeline Order, But Can This Reinvigorate Growth?

- What Is Twitter’s Fundamental Value Based On Expected 2016 Results?

- Twitter’s Valuation: What Is Its Current Discount In The Market Relative To Facebook And LinkedIn?

- By How Much Did Twitter’s Revenue & EBITDA Change In The Last 5 Years?

- Twitter’s Revenue Composition: How Has It Changed And What’s The Future Outlook?

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)