What are the Masters of the Universe Buying?

Submitted by Sizemore Insights as part of our contributors program

What are the Masters of the Universe Buying?

by Charles Lewis Sizemore, CFA

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

- Up 8% This Year, Why Is Costco Stock Outperforming?

You should never blindly follow the investment moves of anyone—not even masters of the universe like Carl Icahn or George Soros. You never know what their investment game plan is or whether a stock position is part of a larger multi-stock trade.

That said, I do consider guru trades a nice starting point for further research. If investors I respect and follow are piling into a stock, then it’s worth investigating.

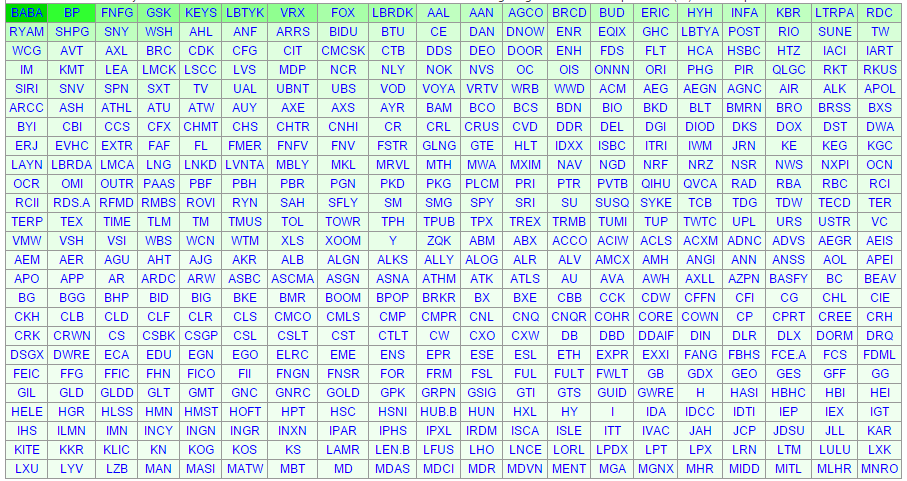

So, with no further ado, let’s see what the gurus are buying today. GuruFocus has a handy heatmap utility that shows guru buying activity. The particular screen I ran today is for large, non-S&P 500 stocks. The stocks in the upper-left-hand corner (the darkest green) are the stocks with the highest concentration of buying by prominent hedge fund and mutual fund managers.

At the top of the list? Chinese ecommerce juggernaut Alibaba (BABA). Alibaba has been recently purchased by 15 gurus, including funds controlled by Julian Robertson, Daniel Loeb, George Soros, John Paulson and Stanley Druckenmiller.

Next up is British oil major BP (BP), which has recently been purchased by 12 gurus. Some names of note: David Einhorn, Bruce Berkowitz and David Dreman. In the interests of full disclosure, I am also long BP.

Should you run out and buy any stock on this list because a famous investor owns it? Obviously not. SEC 13-F data is already dated by the time it is reported. For all we know, all of these legendary investor might have already dumped these stocks this morning . . . or they might be part of a broader strategy that they haven’t shared with us. But I do consider this list a nice starting point for further research. And given the beating that energy stocks have taken of late, I consider BP an attractive contrarian buy.

Charles Lewis Sizemore, CFA, is the chief investment officer of the investment firm Sizemore Capital Management. Click here to receive his FREE weekly e-letter covering top market insights, trends, and the best stocks and ETFs to profit from today’s best global value plays.

This article first appeared on Sizemore Insights as What are the Masters of the Universe Buying?