Expected 10-Year Returns for Major World Markets

Submitted by Sizemore Insights as part of our contributors program

Expected 10-Year Returns for Major World Markets

by Charles Lewis Sizemore, CFA

- Here’s What To Expect From Corning’s Q1

- Should You Pick Alaska Airlines Stock At $45 After Q1 Beat?

- Rising 25% Year To Date, Will Q1 Results Drive Chipotle Stock Higher?

- Visa Stock Is Up 15% In the Last 12 Months, Will The Trend Continue Post Q2 Results?

- What Should You Do With Caterpillar Stock Ahead of Q1?

- Is There Any Room For Growth In CSX Stock After An Upbeat Q1?

Research Affiliates, the research firm led by “smart beta” pioneer Rob Arnott, recently created a great research tool that enables you to choose any eight world markets and compare their valuations. Research Affiliates then takes it a step further by forecasting the expected return over the next 10 years based on those valuations. For those who like to delve into the nitty-gritty details, the forecasting methodology is explained here. Estimates are exactly that: estimates. Real-world results will almost certainly look a lot different than these estimates suggest, but this gives us a nice “quick and dirty” way to gauge how attractively priced a given country is.

As you might suspect, after the run we’ve had since early 2009, the U.S. is priced to deliver pretty disappointing returns over the next decade. But much of the rest of the world is looking pretty attractive.

(Incidentally, Meb Faber’s Idea Farm alerted me to this. If you don’t already subscribe to Idea Farm, I highly recommend you do. It’s a never-ending stream of fantastic resources like these.)

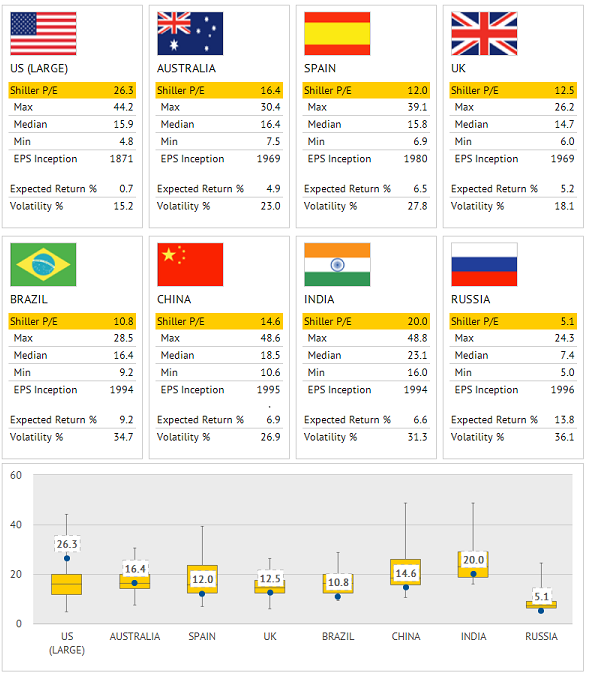

As an example, I chose the following eight markets: the developed markets of the United States, Australia, Spain, the United Kingdom and the emerging markets Brazil, China, India and Russia:

Don’t be intimidated by graphics in the bottom-most graph. Essentially, this graph compares today’s valuation (“CAPE” or “Shiller P/E”) to the historical norm by country. The blue dot is today’s valuation and the yellow box is what you might consider a “normal” range.

Certain countries–such as India–would appear expensive at first glance but are actually still below their long-term averages. Others–such as Spain, Brazil, China, and Russia–are below their “normal” ranges and would thus appear to be absolute bargains with expected annual returns after inflation of 6.5% to 13.8%.

The one outlier here is, of course, the United States. You’ll notice that the blue dot is well above the yellow box that indicates a normal valuation range. Because of this high starting point, Research Affiliates expects inflation-adjusted returns of less than 1% per year over the next decade, which is actually less than the current dividend yield. In other words, don’t expect much in the way of capital appreciation from an S&P 500 index fund.

And what about the cheap markets of Spain, Brazil, China and Russia?

All are cheap for a reason, of course. Spain is still suffering from the fallout of the Eurozone sovereign debt crisis, Russia is the target of Western sanctions and is getting battered by falling crude oil prices, Brazil is suffering from low growth and a lack of competitiveness, and China is sitting on a demographic timebomb from its aging population. Yet these are precisely the times that should excite a value investor. Valuations are cheap and expectations are low.

Is there short-term risk in any of these “problem” markets? Obviously yes. But an intrepid contrarian should use any short-term dips as a buying opportunity for what I expect to be a fantastic decade in non-U.S. equities.

Charles Lewis Sizemore, CFA, is the chief investment officer of the investment firm Sizemore Capital Management. Click here to receive his FREE weekly e-letter covering top market insights, trends, and the best stocks and ETFs to profit from today’s best global value plays.

This article first appeared on Sizemore Insights as Expected 10-Year Returns for Major World Markets