Schlumberger To Buy Cameron, Gets A Better Price Than Halliburton-Baker Hughes Deal

At a time when the free fall of crude oil prices is driving the valuation of energy services companies to an all-time low, the market is set to witness yet another merger leading to further consolidation of the industry. Schlumberger (NYSE:SLB), the world’s largest oilfield contractor, has announced its plans to acquire Cameron International (NYSE:CAM), an oilfield equipment maker, in a stock and cash transaction valued at $14.8 billion((Schlumberger To Acquire Cameron, 26th August 2015, www.slb.com)). The market seemed positive about the deal, since Schlumberger’s stock fell only 3.4% on Wednesday, 26th August, when the news became public, as opposed to a 12% decline witnessed by its closest competitor Halliburton (NYSE:HAL) when it announced the deal with Baker Hughes (NYSE:BHI) in November last year. Cameron’s stock jumped over 40% within a single trading day. Schlumberger expects to close the transaction, which is likely to be accretive within the first year, by the first quarter of 2016, subject to Cameron’s shareholders’ approval and other regulatory approvals. In this article, we will discuss the deal in the light of its rationale and value accretion to the companies.

See Our Complete Analysis For Schlumberger Here

The key highlights of the deal include:

- Cameron shareholders will receive 0.716 shares of Schlumberger’s common stock and a cash payment of $14.44 for each share held for a total deal value of $14.8 billion.

- The deal price of $66.36 per share represents a 56.3% premium to Cameron’s closing stock price of $42.46 per share on Tuesday.

- On closure of the deal, Cameron shareholders will own approximately 10% of Schlumberger’s outstanding shares.

- Synergies of $300 million and $600 million are expected in the first and second years respectively, making the transaction EPS accretive to Schlumberger in the first year itself.

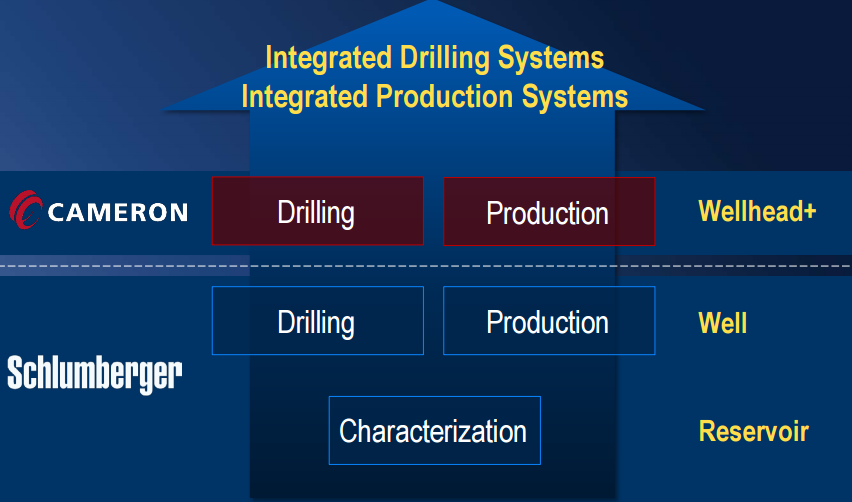

- Combined entity will offer the industry’s first integrated drilling and production system to the oil and gas industry clients.

- With The Stock Flat This Year, Will Q1 Results Drive SLB Stock Higher?

- Down 7% Already This Year, Will SLB Stock Recoup These Losses After Q4 Results?

- Flat Since The Beginning of 2023, What Is Next For SLB Stock?

- SLB’s Q2 Earnings: What Are We Watching?

- SLB Stock To Likely Trade Higher Post Q1

- SLB Stock Looks Attractive At $46

Rationale of the deal

Due to the uncertain outlook for crude oil prices, it looks next to impossible for energy services companies to grow organically. Hence, in the quest for inorganic growth, the mergers and acquisitions (M&A) activities in the industry have gone up significantly over the last one year. The most talked about of these was the $35 billion deal between Halliburton and Baker Hughes announced last year, which is yet to be completed. The deal threatened to create a combined entity which had the potential to challenge Schlumberger’s industry leading position. Since the announcement of that merger, the market had been waiting for a similar move from Schlumberger. However, the oilfield giant took its own time, and finally decided to acquire Cameron, not only to offer an integrated platform by building on its deepwater partnership, but also to create value for its shareholders. Following are the major drivers behind this deal:

Offering Integrated Solutions

Cameron is the world’s largest surface wellhead provider offering a vital set of valves, pumps, and blowout preventers which help to control the flow of oil from the underground reservoirs. The deal will allow Schlumberger to bundle its reservoir and well engineering and digital mapping technologies, with Cameron’s surface, drilling, processing, and flow control technologies to offer an integrated “pore-to-pipeline” product to the global oil and gas industry. This will provide a first-mover advantage to the company and enable it to grow its market share in the long term.

Source: Schlumberger and Cameron Conference Call

Source: Schlumberger and Cameron Conference Call

Diversifying Into Deepwater Market

Schlumberger and Cameron have been working together since 2012 as partners on OneSubsea, a joint venture created to focus on providing integrated deepwater offerings. Besides, Schlumberger has a track record of buying its joint venture partners. In the past, the company has acquired Smith, WesternGeco, Eurasia Drilling, and Dowell on different occasions. Thus, this merger is not a surprise and was reasonable for it to happen sooner or later. Further, the deal will enable Schlumberger to diversify further into the deepwater market and leverage Cameron’s heavy-duty offshore drilling hardware such as gears and blowout preventers.

Source: Schlumberger and Cameron Conference Call

Source: Schlumberger and Cameron Conference Call

EPS accretive

Schlumberger expects to realize pretax synergies of approximately $300 million in the first year and $600 million in the second year. In the first year, the synergies will primarily be cost related which would include reduction of operating costs, streamlining of supply chains, and improving manufacturing processes. In the second year and beyond, the synergies will predominantly come from revenue consolidation. In addition, the company claims that the deal will be accretive to its earnings per share within the first year of deal closure.

Source: Schlumberger and Cameron Conference Call

Does The Deal Make Sense?

In the current environment where all the energy services companies are struggling to weather the downturn, Schlumberger has actually managed to hold up quite well. The company maintained a flat operating margin despite a notable decline in its top line. Thus, if any energy service company can successfully pull off a merger at this time, it is Schlumberger. Apart from enhancing the company’s product offering, the following are some of the reasons why we think that the deal makes financial sense for the company:

Better Price

Unlike its competitor Halliburton, Schlumberger has strategically timed its merger with Cameron. Of late, the global markets have plunged due to fears over a slowdown in the Chinese economy. This further pulled down the crude oil prices and reversed all the recovery that took place in the first six months of 2015. This resulted in a further decline in the valuation of energy services companies. Thus, Schlumberger hit the hammer just when the iron was hot and announced this deal. Interestingly, Schlumberger is paying a premium of 56.3% to the shareholders of Cameron, which is identical to the premium paid by Halliburton to the shareholders of Baker Hughes. However, the latter deal was announced almost a year back when oil prices were close to $75 per barrel, as opposed to the current scenario where the oil prices have gone below $40 per barrel. In addition, Cameron’s stock has slipped more than 35% over the last one year. Thus, it is apparent that Schlumberger got a better deal than its competitor.

Value Accretive

Though Schlumberger claims that the deal will be EPS accretive in the first year itself, we did a quick back of the envelope calculation to cross check the company’s stance. At the end of the June quarter, Schlumberger had a cash balance of over $3.5 billion. This indicates that the company has a strong cash balance to carry out the deal without taking on more debt. Further, based on the cost synergies anticipated by the company, we estimate that the present value of these synergies to Schlumberger’s shareholders will be approximately $3.1 billion (considering Schlumberger’s 90% stake in the combined entity and a discounted rate of 9.8%), which is lower than the cash consideration of $2.8 billion that is being paid to Cameron’s shareholders. Thus, the deal will be value accretive for Schlumberger in the first year as claimed by the company.

Source: Schlumberger and Cameron Conference Call

Minimal Regulatory Concerns

Unlike the Halliburton and Baker Hughes deal, which is yet to close due to antitrust issues, this deal is more focused on diversification into oilfield equipment supply, rather than eliminating competition. Since Schlumberger and Cameron cater to different markets and clients, the transaction is less likely to attract antitrust issues. Consequently, there are more chances of the deal going through without any divestitures or regulatory hurdles.

In a nutshell, we expect the deal to be value accretive for the shareholders of both Schlumberger and Cameron driven by cost and revenue synergies in the short term, and integrated product offerings in the long term.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap