Were The U.S. Wireless Price Wars Just A Mirage?

The U.S. wireless industry has seen an upheaval of sorts over the last three and a half years, after T-Mobile (NASDAQ:TMUS) launched its “Uncarrier” initiative in March 2013, setting the stage for the end of the two year contract model, while slashing service pricing. A flurry of activity ensued over the next two years, with the major carriers doing away with their legacy contract plans, while offering customers greater value (lower per-gigabyte data prices, no overages etc.) and flexibility. While T-Mobile’s moves are perceived to have hurt the industry, the financial performance and operating metrics of the large carriers actually seem to indicate otherwise. Below we provide a summary of how the wireless market has shaped up in the wake of T-Mobile’s initiatives.

See our complete analysis for Verizon | AT&T |T-Mobile| Sprint

ARPUs Decline, But Carriers Haven’t Compromised On Their Revenue Base

- Sprint’s Stock Looks Expensive Compared To AT&T After Rising 93% In 2 Months!

- Sprint’s Stock Price Doubled In 15 Days; Is Market Overvaluing Sprint Just Before Its Merger With T-Mobile?

- Where Is Sprint Corp Spending Most Of Its Money?

- Machine Learning Answers: Sprint Stock Is Down 15% Over The Last Quarter, What Are The Chances It’ll Rebound?

- Sprint Valuation: Fairly Priced

- How Does Sprint Make Money?

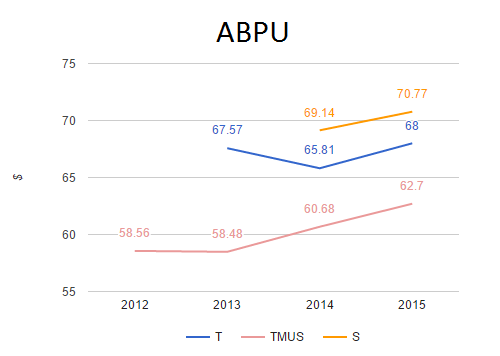

The postpaid average revenue per user of the big four wireless carriers has seen a decline over the last three years. While T-Mobile’s ARPU fell by about 16% between 2012 and 2015, declines for the other three carriers over the same period were more muted, ranging from 3% to 7%. That said, ARPUs are becoming a less relevant measure of per-subscriber revenues, given the shift to equipment installment plans, and carriers do not seem to have compromised much in terms of their overall revenue base, as the growing ABPU metric indicates.

With installment plans, such as AT&T’s Next and T-Mobile’s Simple Choice, carriers typically lower monthly service fees (based on which ARPU is calculated) and make customers pay for their handsets separately in installments or buy them outright, rather than baking handset subsidies into monthly service fees. The ABPU metric, which includes monthly service payments plus installment billings, has largely exceeded the ARPUs that carriers were posting prior to the introduction of contract-free plans. T-Mobile’s 2015 ABPU stood at about $63, well ahead of its ARPU of $57 in 2012 prior to the launch of its Uncarrier scheme. AT&T’s 2015 ABPU is also slightly ahead of its ARPU prior to the launch of its Next plan. ABPUs have also been seeing growth. T-Mobile’s ABPU has risen by about 7% since 2013, while AT&T and Sprint have also seen modest gains since they launched their plans in 2014.

With installment plans, such as AT&T’s Next and T-Mobile’s Simple Choice, carriers typically lower monthly service fees (based on which ARPU is calculated) and make customers pay for their handsets separately in installments or buy them outright, rather than baking handset subsidies into monthly service fees. The ABPU metric, which includes monthly service payments plus installment billings, has largely exceeded the ARPUs that carriers were posting prior to the introduction of contract-free plans. T-Mobile’s 2015 ABPU stood at about $63, well ahead of its ARPU of $57 in 2012 prior to the launch of its Uncarrier scheme. AT&T’s 2015 ABPU is also slightly ahead of its ARPU prior to the launch of its Next plan. ABPUs have also been seeing growth. T-Mobile’s ABPU has risen by about 7% since 2013, while AT&T and Sprint have also seen modest gains since they launched their plans in 2014.

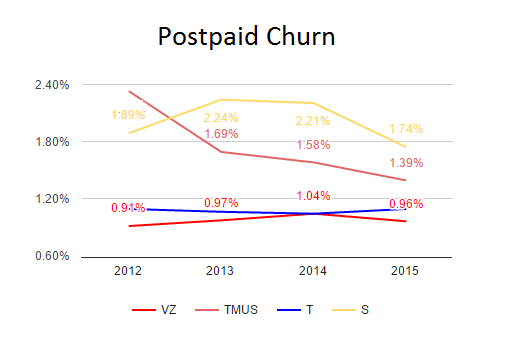

Postpaid Churn Figures Improved Even As Carriers Abandoned Contract Model

Subscriber contracts were primarily seen as a means of improving customer loyalty, by locking customers onto a postpaid plan for two years. However, interestingly, the end of the contract era has actually brought about a reduction in postpaid churn rates across the industry. For instance, Sprint has seen churn decline from 1.89% in 2012 to about 1.74% in 2015, with further improvements during H1 2016. T-Mobile’s churn has also fallen sharply, from 2%+ levels to about 1.4% in 2015. The bigger two players have seen churn remain largely unchanged at between 0.9% to 1.1%. While this is partly due to improved customer quality across the industry, the increasing number of devices per account on shared plans is also keeping subscribers from defecting.

Wireless EBITDA Margins Trended Higher

All four national wireless players have been recording margins gains over the last three years. To be sure, a bulk of the expansion comes from the accounting practice of booking equipment revenues up front under installment schemes (versus only down payments in a traditional subsidy plan) and also due to higher leasing activity in the case of Sprint. That said, carriers’ margins are also benefiting from the improving billings per subscriber, lower subsidy expenses and improving churn rates, which are helping to rein in marketing spending.

Wireless Stocks Have Seen Gains

Most wireless stocks have also recorded gains over the last three years, although performance has been mixed compared to the broader market. T-Mobile has outperformed, rising by about 170% since it went public in May 2013, as it benefited from its early mover-advantage, capturing a bulk of the postpaid subscriber growth in the U.S. market in recent years. The stocks of market leaders Verizon and AT&T, had a more subdued performance, with prices up by about 20% and 18%, respectively, since early 2013, underperforming the S&P 500. Sprint – which bore the brunt of T-Mobile’s initiatives – has seen its stock remain relatively flat since 2013, after posting reasonable growth this year.

Notes: 1) Verizon’s ARPU based on quarterly average overall postpaid ARPU. Phone-only ARPU used for other carriers. 2) Company-wide adjusted EBITDA margins for T-Mobile and Sprint. Q4 Wireless EBITDA margins for AT&T.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research