By How Much Will Roche’s Revenues And Earnings Grow In The Next 3 Years?

By How Much Will Roche’s Revenues And Earnings Grow In The Next 3 Years? Below we provide a Key-Point schematic that very clearly answers this questions. For our complete analysis and topical articles on Roche, see the link below. For similar Key-Point questions and answers, the the list below.

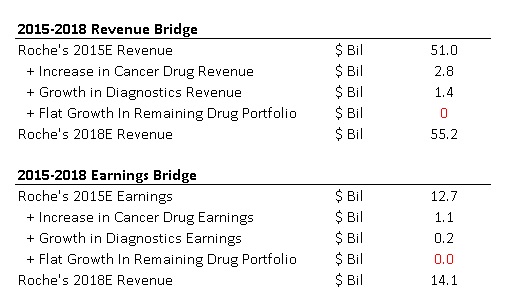

Roche’s Expected Revenue & Earnings Growth Between 2015 – 2018 ~ 10%

Low Growth Due To Expected Biosimilar Competition And Patent Expirations

Have more questions about Roche? See the links below.

- What Drove 15% Growth in Roche’s Earnings Between 2011-2014 Even Though Other Big Pharma Companies Suffered A Decline?

- Why Is Market Assigning Low Earnings Multiple To Roche Despite Its Biotech Focus?

- Can Roche Grow Its Earnings By 15% In The Next 3 Years?

- With Biosimilars Getting Approval In Europe, Does Roche’s 2016 EPS Face A Meaningful Risk?

- How Can Roche Get 25% Boost In Revenues In 5 Years?

- Can Emerging Biosimilar Competition Cause > 10% Downside To Roche’s Valuation?

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)