What’s In The Box For Qlik As Thoma Bravo Completes Qlik Acquisition?

The acquisition process of Qlik Technologies by a private equity firm Thoma Bravo was completed on August 22, 2016. The deal was completed for around $3 billion, in which Qlik shareholders got the price of $30.50 per share. Trading in Qlik was suspended after the completion of this acquisition.

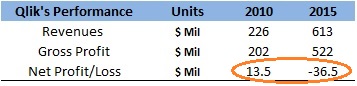

Since it went public in 2010, Qlik has performed well on the revenues and gross profit front as the two figures increased by 170% and 158% respectively. On the other hand, due to high Selling, General and Administrative (SG&A) and R&D expenses, Qlik’s net earnings continued to decline over time and it reported net loss for the last 3 consecutive years. Young software companies typically invest heavily in building and installed base and are typically break-even at best on an operating basis.

See our complete analysis for Qlik

Qlik Can Take Advantage of Thoma Bravo’s Resources

- Qlik Sense Drives Qlik’s Strong Q2’16 Results

- Continued Innovation and New Partnerships to Drive Qlik’s Q2’16 Revenues

- Here’s Why We Are Revising Our Price Estimate of Qlik From $36 to $28

- Qlik Sense’s Success and Domestic Market Drove Qlik’s Revenue Expansion in Q4

- Here’s Why The Recent Drop in Qlik’s Share Price is Unwarranted

- Qlik’s Growth Slowed in Q3, But Near Term Outlook Remains Strong

Historically, Thoma Bravo is known for its successful acquisitions of tech firms. It bought cloud security firm Blue Coat in 2012 for $1.3 billion and sold it off to Bain Capital in early 2015 for $2.4 billion. During this time, Blue Coat almost tripled its EBITDA. Similarly, if Qlik can make use of Thoma Bravo’s resources to improve its operational efficiencies, then there might be some improvement in its bottom-line in coming years as the company reaps the benefits of increased R&D and headcount.

Thoma Bravo Can Hope For A Good Price For Qlik In Future

With the rising demand for Business Intelligence and Analytics among the enterprises in emerging markets, there is a good opportunity for Qlik to expand into these geographies and boost its already growing top-line with its competitive products like Qlik Sense 3.0 and Qlik View. According to Gartner, worldwide BI market is expected to increase by 5.2% in 2016 to about $16.9 Billion with higher growth in developing economies. This should help Qlik to strengthen its base and generate sufficient revenue growth to be profitable on an operating basis. It seems likely Thoma Bravo to divest Qlik at a good premium in future.