Coca-Cola And PepsiCo Should Be Eyeing Bottled Water Growth In Emerging Markets

Packaged water will soon be the most consumed beverage in the world, and seeing how there is a huge opportunity in this segment in most emerging markets, beverage giants such as The Coca-Cola Company (NYSE:KO) and PepsiCo (NYSE:PEP) will look to leverage their strong brand appeal and ecosystem to further penetrate this segment. According to the Canadean, consumption of packaged water will reach 233 billion liters in 2015, more than the intake of carbonated soft drinks (CSDs), which is estimated to be around 227 billion liters. [1] While growth in the bottled water category is expected to continue outpacing growth in the CSD category in the next few years, most of this growth will come from emerging markets such as China, Mexico, and India–where clean tap water is not as easily available.

We estimate a $44 stock price for Coca-Cola, which is above the current market price.

See our full analysis for Coca-Cola

- Will PepsiCo Beat The Consensus In Q1?

- What’s Next For Pepsi Stock After A Mixed Q4 And 6% Fall Last Year?

- After A 25% Fall In 2023 Is Campbell A Better Pick Than PepsiCo Stock?

- What’s Next For PepsiCo Stock After A Q3 Beat?

- What To Expect From PepsiCo’s Q3?

- Which Is A Better Pick – PepsiCo Stock Or Amgen?

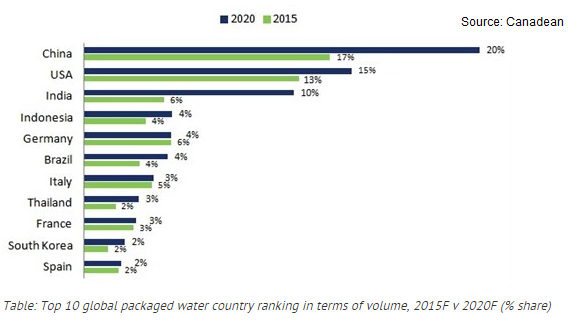

The bottled water market in emerging countries provides potential growth opportunities for beverage companies due to widespread concerns over the safety of tap water, and the inconvenience and expense of boiling large quantities of water in these countries. In addition, growing beverage volumes in developed markets, such as Europe, has become tougher in recent times, as health concerns deter customers from consuming sugary carbonated drinks, and the easy availability of clean water keeps sales of packaged water in check. In fact, while bottled water is estimated to grow only modestly in most developed economies, China and India are estimated to account for approximately half of the world’s additional bottled water consumption in 2020, consuming a total of ~45 billion liters more than in 2015.

In this article, we will discuss the bottled water market situations in China, India, and Mexico.

We estimate a $98 price for PepsiCo, which is above the current market price.

See Our Complete Analysis For PepsiCo

China:

China overtook the U.S. as the world’s largest bottled water market in 2013, and there is still large potential in this market, which doubled volume sales from 17 billion liters to 33 billion liters in five years. [2] This is because there remains a shortage of freshwater supply in a country which forms one-fifth the global population, but has only 7% of the world’s freshwater supplies. Apart from volume growth, why bottled water in China holds potential is because of increasing revenue-per-unit in this segment. Bottled water is typically dilutive to the overall company margins, which is why despite the ever-so-growing packaged water demand, Coca-Cola and PepsiCo haven’t looked to aggressively expand in this category.

However, growing health awareness and increasing purchasing power has prompted a shift in focus in China’s bottled water market from bottled purified water to bottled natural mineral water, which operates at higher price points. In a bid to attract more affluent customers, more niche and premium bottled water brands are expected to be introduced in the country, which adds more incentive to selling packaged water.

As of now, the domestic company Ting Hsin International Group leads this market with around 12% share, while Coca-Cola, which sells Ice Dew in the country, holds a smaller 5.6% share. China’s bottled water market is set to grow at a fast pace, and premiumization in this segment provides a solid opportunity for beverage makers such as Coca-Cola and PepsiCo to grow volumes organically as well as protect profitability by operating at higher prices. In addition, the fact that no particular company commands a massive share in this market might mean that bottled water growth in the country might be up for grabs.

Mexico:

While China leads the world in terms of volume sales of water, Mexico is the world’s largest packaged water consumer in terms of value and also per capita consumption (~234 liters per capita). Mexico’s bottled water market was worth $7.8 billion last year, up 56% since 2009. [3] This figure is expected to swell to $9.4 billion by 2019. Lesser availability of clean tap water in the country and the introduction of the one-peso-per-liter tax on sodas in January last year have kept sales of bottled water high. As approximately half of the Mexico’s population lives below the national poverty line, a rise in prices of carbonated drinks prompted some consumers to switch to bottled water. Sparkling water is considered a safer and healthier alternative to sugary drinks as consumers look to refrain from sugar intake, but prefer the carbonation. Some sparkling water brands also don’t fall under the tax as manufacturers reduced the sugar content in these drinks, in order to avoid levying the added tax onto the customers.

Danone’s Bonafont brand leads the Mexican bottled water with a large 47% share, followed by Coca Cola’s Ciel and Pepsico’s Epura, which hold respective shares of 19.4% and 7.1%, respectively. Although the country provides potential volume growth opportunities for beverage makers, growth in this market might be dilutive to the company margins. This is because the popular option for households in the country is to purchase 20-liter “garrafones” which have a lower price per liter compared to the smaller volume bottles.

India:

There exists the same problem of less availability of clean water supply in the world’s second most populous country as well. However, with increasing incomes, Indians are now consuming more than 20 liters of bottled water per head every year, compared to only 4-5 liters 15 years ago. This figure is still dwarfed by the much larger per capita consumption for Mexico, and the 130 liter per-capita-per-year intake by the U.S. population. The Indian bottled water market, worth ~$1.14 billion presently, is expected to grow at an impressive CAGR of 22% to over $2.5 billion by 2018. [4] Parle Bisleri, Coca-Cola, and PepsiCo lead this market, with Bisleri holding almost 40% value share. [5]

What is common between the China, Mexico, and India bottled water markets is that they are growing at a fast pace, boosted by improving purchasing power, and rising demand for clean and fresh water. Another thing that stands out is that Coca-Cola and PepsiCo don’t command a leading position in any of these markets, which is unlike their position in carbonated soft drinks in these markets, where the two giants together hold 50% or more share. This might be because water is typically a low margin business.

Coca-Cola and PepsiCo already have well-established distribution channels in China, Mexico, and India, and might look to leverage their solid presence in these markets to further their packaged water sales as well, especially as a large portion of water sales are lost to the unorganized sector, and small vendors who are seated deep within the countries. Seeing how packaged water will now be the most consumed beverage in the world, it might be time for the world’s two largest beverage makers to further strengthen their reach and portfolio in the emerging markets–where most of the bottled water growth is expected to come from.

See the links below for more information and analysis:

- Bottled water is a potential growth category that can’t be ignored

- Soda makers wonder: where could growth in U.S. come from?

- Coca-Cola beats consensus estimates; delivers strong growth in Q1

- Negative currency translations overshadow PepsiCo’s strong organic growth in Q1

- Trefis analysis: PepsiCo Soft Gatorade and Other Beverages Revenues

- Trefis analysis: Coca-Cola Dasani International Revenues

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research