Currency Fluctuation And Weakness In Print Advertising Weighs Over News Corporation’s Q3 Fiscal 2014 Earnings

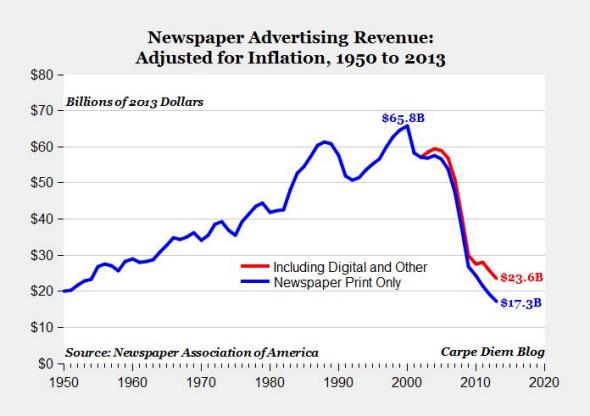

News Corporation (NASDAQ:NWSA) recently posted its fiscal Q3 2014 results. The revenues declined by 5% to $2.08 billion and adjusted earnings were $0.11 as compared to $0.13 in the prior year period. [1] While the company continues to see growth at HarperCollins and REA, print advertising remains a concern. It must be noted that the overall print advertising revenues in the U.S. are presently at the lowest they’ve been since 1950, when the Newspaper Association of America began tracking industry data. [2] Overall, the company reported mixed results with growth in book publishing and digital real estate, while news and information service as well as cable networks faced some headwinds due to currency fluctuations.

The company recently announced its plans to acquire Harlequin Enterprises from Torstar Corporation for $415 million. [1] Harlequin Enterprises is a Canada based company that publishes broad range of fiction including romance, relationship, psychological thrillers and women’s fiction. The company publishes approximately 120 new titles each month in 29 different languages in 107 international markets. The acquisition will help HarperCollins to significantly broaden its global footprint, strengthen the key content vertical and expand its backlist while importantly improving its financial profile, according to News Corporation’s management. [1]

See our complete analysis for News Corporation

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

News & Information Services Face Currency Headwinds

News and information services revenues declined 9% to $1.49 billion as compared to $1.63 billion in the prior year quarter. Segment EBITDA also declined 12% to $146 million. [3] This can be attributed to lower advertising revenues, especially at Australian newspapers, principally resulting from the adverse impact of foreign currency fluctuations. Australia accounted 70% of the segment decline due to foreign currency fluctuations. However, the weakness in the print advertising market can be seen in Australia, the U.K. as well as the U.S. The chart below states the U.S. newspaper advertising revenues adjusted for inflation from 1950 to 2013.

It is not just advertising that weighed on segment results, circulation and subscription revenues declined by 5% due to lower institutional revenues at Dow Jones. However, circulation improved for The Wall Street Journal and WSJ.com. In April, The Wall Street Journal increased subscription pricing for new customers by an additional $2 per month for both its digital-only and print digital bundle.

News And Information Service is an important segment for News Corporation. It accounts for more than 40% of the company’s value, according to our estimates. The environment for print industry in particular is challenging. As Internet penetration continues to expand, users increasingly get access to free and abundant information online. We believe that the continuing trend could keep putting a downward pressure on circulation prices and advertising income.

HarperCollins And Digital Real Estate Grow Strong

Book publishing revenues increased 14% to $354 million while EBITDA jumped 83% to $53 million. [3] The increase in revenues was primarily due to higher print and digital book sales, principally resulting from sales of the Divergent series by Veronica Roth. The Company sold more than 8 million units of the Divergent series during the March quarter, 28% of which were e-book sales. Higher EBITDA reflects the impact of operational efficiencies and higher contributions to profits from e-books. It must be noted that digital books have lower production and distribution costs than print books. We believe HarperCollins will continue to grow strongly as e-book sales pick up.

Digital real estate operations contribute close to 25% to News Corporation’s value, according to our estimates. It includes REA, which owns and operates Australia’s largest residential as well as commercial property websites. The revenues at this segment increased 19% to $102 million and segment EBITDA grew 29% to $53 million, primarily due to increased listing depth product penetration in Australia. [3] It must be noted that digital real estate segment’s EBITDA margins are much higher than book publishing. In 2013, EBITDA margins for digital real estate were more than 45% as opposed to 7% for book publishing. We estimate continued growth in this segment throughout the forecast period primarily driven by the growth in Australia’s population, which is being reflected on the housing market. Strong demand, short supply, weaker Aussie dollar and record low borrowing cost is pushing the housing prices of Australian real estate higher.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Get Trefis Technology

- News’ (NWSA) CEO Robert Thomson on Q3 2014 Results – Earnings Call Transcript, Seeking Alpha, May 8, 2014 [↩] [↩] [↩]

- The Decline of Newspapers Hits a Stunning Milestone, Slate, Apr 28, 2014 [↩]

- News Corporation’s SEC Filings [↩] [↩] [↩]