How The Slowdown In Storage Hardware Will Impact NetApp This Year

Storage systems vendor NetApp (NASDAQ:NTAP) has had a tough couple of years, with revenue declines in both 2014 and 2015. This was largely due to tepid demand for storage products – a trend consistent across most large storage vendors including EMC (NYSE:EMC), IBM (NYSE:IBM) and HP Enterprise (NYSE:HPE). In previous years, NetApp made up for low product revenues by growth in hardware maintenance contracts and post-sale services. However, in recent quarters, this revenue stream has also suffered. In the most recent quarter, the only revenue channel that showed positive growth was software maintenance, with a modest 3% annual growth in revenues. With a slowdown in IT spend by customers across the globe, it could be difficult for NetApp to drive top line growth through 2016. We forecast NetApp’s net revenues for the full year to decline by about 6% to under $5.4 billion.

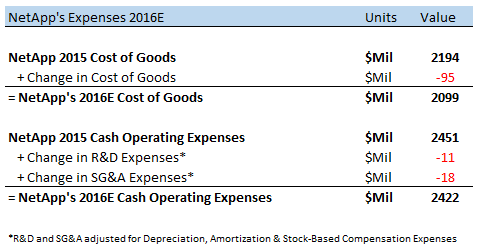

Low product sales have led to discounted selling prices, which ultimately drove down product margins significantly. The adjusted gross margin for the product division has fallen from under 56.3% in 2014 to around 50.3% in 2015. This could further fall to around 47.3% in 2016. Comparatively, the hardware maintenance and services gross margin has improved from 58% in 2013 to over 63% in 2015. Although the gross margins for the hardware maintenance and software maintenance divisions have improved over the last couple of years, it has not been enough to offset the negative impact by the hardware division. On the other hand, the company has made efforts to improve operational efficiency by reducing cash operating expenses through its fiscal 2016 thus far. This could result in low sales & marketing and research & development expenses as a percentage of net sales.

Low product sales have led to discounted selling prices, which ultimately drove down product margins significantly. The adjusted gross margin for the product division has fallen from under 56.3% in 2014 to around 50.3% in 2015. This could further fall to around 47.3% in 2016. Comparatively, the hardware maintenance and services gross margin has improved from 58% in 2013 to over 63% in 2015. Although the gross margins for the hardware maintenance and software maintenance divisions have improved over the last couple of years, it has not been enough to offset the negative impact by the hardware division. On the other hand, the company has made efforts to improve operational efficiency by reducing cash operating expenses through its fiscal 2016 thus far. This could result in low sales & marketing and research & development expenses as a percentage of net sales.

- Up 27% Over The Past Year, Will Higher Margins And Cloud Sales Drive NetApp Stock Higher Post Q3 Earnings?

- Up 28% Since The Beginning Of 2023, What’s Next For NetApp Stock?

- What To Expect From NetApp’s Q4 Results?

- NetApp Stock Looks Attractive Despite Easing IT Spending

- Despite A Rise In Sales, Here’s Why NetApp Stock Has Underperformed The S&P

- After Strong Outperformance, Can NetApp Stock Maintain Its Streak?

NetApp’s adjusted EBITDA margin stood at 18.6% in 2015, which was about 5 percentage points lower than the previous year. Although NetApp’s management has made efforts to reduce expenses, the declining trend could continue in 2016 as well with the adjusted EBITDA likely to fall by about 20% and the operating margin falling by about 3 percentage points. [1]

Have more questions about NetApp? See link below:

- What Lies Ahead For NetApp’s Software, Entitlements & Maintenance Sales?

- Where Does NetApp Stand In A Stagnating Storage Systems Market?

- What Will NetApp’s Revenue And EBITDA Look Like In 5 Years?

- How Crucial Is Hardware Maintenance To NetApp’s Product Sales?

- What Is NetApp’s Presence In The Storage Systems Market?

- ODM Storage Vendors Gain Share From Giants: EMC, HP, IBM, NetApp Lose Market Presence

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- NetApp To Slash 12 Percent Of Workforce, Fortune, February 2016 [↩]