Where Does NetApp Stand In A Stagnating Storage Systems Market?

Storage systems vendors have observed a decline in revenues due to a slowdown in hardware sales over the last few years. Correspondingly, large storage vendors such as NetApp (NASDAQ:NTAP), EMC (NYSE:EMC), IBM (NYSE:IBM) and HP Enterprise (NYSE:HPE) have reported year-over-year declines in storage revenues of late. Most large vendors have reported declines in product revenues greater than the industry-wide decline, as they are increasingly facing competition from smaller vendors and flash-storage startups.

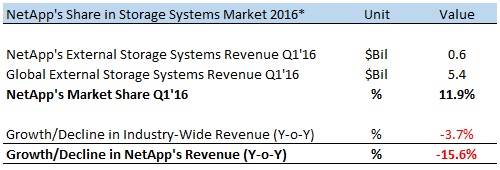

Over the last few years, customer preference has been shifting to low-cost original design manufacturer (ODM) storage boxes, which is cutting into the addressable market for large vendors. [1] This has resulted in a loss of share for large storage vendors at the expense of smaller providers. According to IDC data, the combined share of vendors outside the five largest vendors has increased from 25.7% in 2013 to 31.5% in 2015. [2] Comparatively, NetApp’s share in the storage systems market declined from 13% in 2013 to about 11% in 2015, as its revenues declined at a CAGR of almost 9% compared to the industry-wide decline of 1% in the same period.

- Up 27% Over The Past Year, Will Higher Margins And Cloud Sales Drive NetApp Stock Higher Post Q3 Earnings?

- Up 28% Since The Beginning Of 2023, What’s Next For NetApp Stock?

- What To Expect From NetApp’s Q4 Results?

- NetApp Stock Looks Attractive Despite Easing IT Spending

- Despite A Rise In Sales, Here’s Why NetApp Stock Has Underperformed The S&P

- After Strong Outperformance, Can NetApp Stock Maintain Its Streak?

The trend continued in the March quarter this year, as NetApp reported a 17% year-over-year decline in combined product revenues for the quarter. According to the Q1 performance of storage systems vendors compiled by IDC, NetApp’s share in the market stood at 11.9% as its storage hardware revenue declined by nearly 16% on a y-o-y basis. [3] The March quarter was the first quarter for which IDC reported a year-over-year decline in total capacity shipments – a 4% decline to 27.8 exabytes shipped through the quarter.

We forecast NetApp’s storage hardware revenue to decline at a CAGR of 1% over the next few years, which would negatively impact its share in the market. Despite the likely decline, NetApp faces stiff competition from competing storage systems providers including HPE, Hitachi Data Systems and IBM, with their market shares ranging from 8-12%. Comparatively, EMC has a nearly 30% market share in the external storage systems market.

We forecast NetApp’s storage hardware revenue to decline at a CAGR of 1% over the next few years, which would negatively impact its share in the market. Despite the likely decline, NetApp faces stiff competition from competing storage systems providers including HPE, Hitachi Data Systems and IBM, with their market shares ranging from 8-12%. Comparatively, EMC has a nearly 30% market share in the external storage systems market.

Have more questions about NetApp? See link below:

Have more questions about NetApp? See link below:

- What Lies Ahead For NetApp’s Software, Entitlements & Maintenance Sales?

- What Will NetApp’s Revenue And EBITDA Look Like In 5 Years?

- How Crucial Is Hardware Maintenance To NetApp’s Product Sales?

- What Is NetApp’s Presence In The Storage Systems Market?

- ODM Storage Vendors Gain Share From Giants: EMC, HP, IBM, NetApp Lose Market Presence

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- The Rise Of White-Box Storage, Network Computing, August 2014 [↩]

- Gartner Says Data Center Infrastructure ODMs Are a Key Threat to Data Center OEMs’ Direct Business, Gartner Press Release, September 2014 [↩]

- Worldwide Enterprise Storage Market Sees Continued Decline in First Quarter, IDC Press Release, June 2016 [↩]